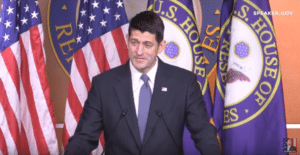

House Passes Tax Bill

On November 16, 2017, the House of Representatives approved its tax reform package, the Tax Cuts and Jobs Act that

On November 16, 2017, the House of Representatives approved its tax reform package, the Tax Cuts and Jobs Act that

An updated version of the Senate Republicans’ tax reform bill includes the repeal of the Patient Protection and Affordable Care Act’s

Pennsylvania Governor Tom Wolf has signed legislation amending the corporate income tax net operating loss (NOL) deduction, creating a Manufacturing

The House Ways and Means Committee advanced to the full House the proposed Tax Cuts and Jobs Act on November

Early on Monday of this week, House Ways and Means Chairman Kevin Brady (R-Texas) released a Chairman’s mark of the

All states imposing a sales and use tax regime are struggling to collect taxes due on sales made through the

The Commonwealth of Pennsylvania currently limits through its tax laws the amount of net operating loss from a loss year

House Republican leaders released the first cut of the 2017 Tax Reform legislation on November 2, 2017, setting forth their

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_gtag_UA_60038340_2 | 1 minute | This cookie is installed by Google Analytics The cookie is used to throttle the request rate. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visited in an anonymous form. |