2021 Payroll Updates and Other Important Tax Developments

As you begin the new year, we would like to remind you of a number of important business changes that

As you begin the new year, we would like to remind you of a number of important business changes that

The Coronavirus Aid, Relief and Economic Security (CARES) Act as well as the Families First Coronavirus Response Act (FFCRA), both

As you begin the new year, we would like to remind you of a number of important business changes that

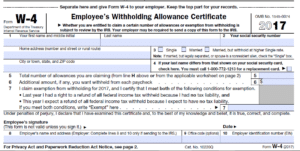

The Form W-4, the Employee’s Withholding Allowance Certificate, determines the amount of Federal Income Taxes to be withheld from an

As you begin the new year, we would like to remind you of a number of important business changes that

The massive changes set forth in the Tax Cuts and Jobs Act (TCJA) signed by the President on December 22,

A problem arising from the lateness in 2017 of enacting the Tax Cuts and Jobs Act on December 22, 2017,

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_gtag_UA_60038340_2 | 1 minute | This cookie is installed by Google Analytics The cookie is used to throttle the request rate. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visited in an anonymous form. |