Pennsylvania Expands Child and Dependent Care Tax Credit

Pennsylvania taxpayers filing their 2023 individual returns can take advantage of the Child and Dependent Care Enhancement Tax Credit for

Pennsylvania taxpayers filing their 2023 individual returns can take advantage of the Child and Dependent Care Enhancement Tax Credit for

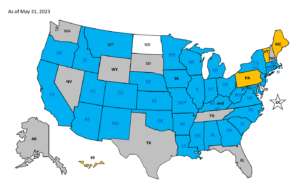

Many states throughout the United States have implemented what are referred to as “pass-through entity tax elections” (PTET elections), since

Businesses that meet the requirement for the federal Research & Development (R&D) tax credit and perform R&D activities within the

On July 8, 2022, Pennsylvania Governor Tom Wolf signed the Commonwealth’s $45.2 billion 2022-23 budget, which includes record investments in

Following the lead of the IRS, which recently announced an extension of the filing deadline for federal income taxes for

Long-awaited relief is on the way for Pennsylvania business owners in an industry that has been hit hard by the

As the Commonwealth of Pennsylvania’s General Assembly prepares for the start of a new legislative session, Governor Tom Wolf outlined

On July 16, 2020, Governor Tom Wolf announced a new program to aid Pennsylvania employers in providing hazard pay to

On June 8, 2020, Pennsylvania Governor Tom Wolf announced a $225 million grant program to support the State’s small businesses

On March 30, 2020, the Pennsylvania Attorney General’s office launched “PA CARE Package,” an initiative focused on securing economic relief

On March 25, 2020, Pennsylvania Governor Tom Wolf announced that the State has created a $60 million loan program, the

As is well known by now (see related posts below), the federal government has extended the due dates for filing

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_gtag_UA_60038340_2 | 1 minute | This cookie is installed by Google Analytics The cookie is used to throttle the request rate. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visited in an anonymous form. |