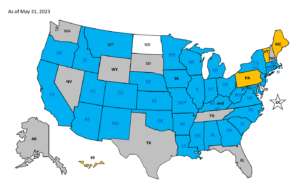

36 States Enact PTE Tax Elections with More Soon to Follow

Many states throughout the United States have implemented what are referred to as “pass-through entity tax elections” (PTET elections), since

Many states throughout the United States have implemented what are referred to as “pass-through entity tax elections” (PTET elections), since

A recent post discussed how many states are providing options for pass-through entities (S corporations, partnerships, or LLCs treated as

Prior to the Tax Cuts and Jobs Act (TCJA) in 2017, generally there was no limit to the amount of

Though the U.S. House of Representatives continues to work through the ongoing impeachment proceedings, the Chamber has apparently found time

One of the most controversial provisions of the Tax Cuts and Jobs Act, enacted in December, 2017, was the cap

Historically, individual taxpayers have been allowed an itemized income tax deduction for one hundred (100) percent of all state and

In years prior to 2019, and the enactment of the Tax Cuts and Jobs Act (TCJA), taxpayers were accorded an

Not subject to as much media attention as federal income tax legislation, the state impacts resulting from the enactment of

As has been discussed frequently in our posts, the Tax Cuts and Jobs Act of 2017 limited the amount of

IRS Reiterates Its “Prepaid Property Tax” Position for NJ Under the Tax Cuts and Jobs Act (TCJA), enacted on December

In response to the Notice issued by the Internal Revenue Service (IRS) requiring taxpayers to adhere to federal tax law

The U.S. Department of the Treasury and the Internal Revenue Service issued Notice 2018-54 advising taxpayers that proposed regulations will

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_gtag_UA_60038340_2 | 1 minute | This cookie is installed by Google Analytics The cookie is used to throttle the request rate. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visited in an anonymous form. |