In deference to fairness, on April 9, 2020, the Internal Revenue Service issued Notice 2020-23, which extended the tax filing and payment deadline to now apply to all taxpayers that have a filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020.

In addition to tax-exempt organizations, individuals, trusts, estates, corporations and other non-corporate tax filers now qualify for the extra time. The Internal Revenue Service previously announced this extension for certain taxpayers with federal income taxes originally due on April 15. (see related posts below)

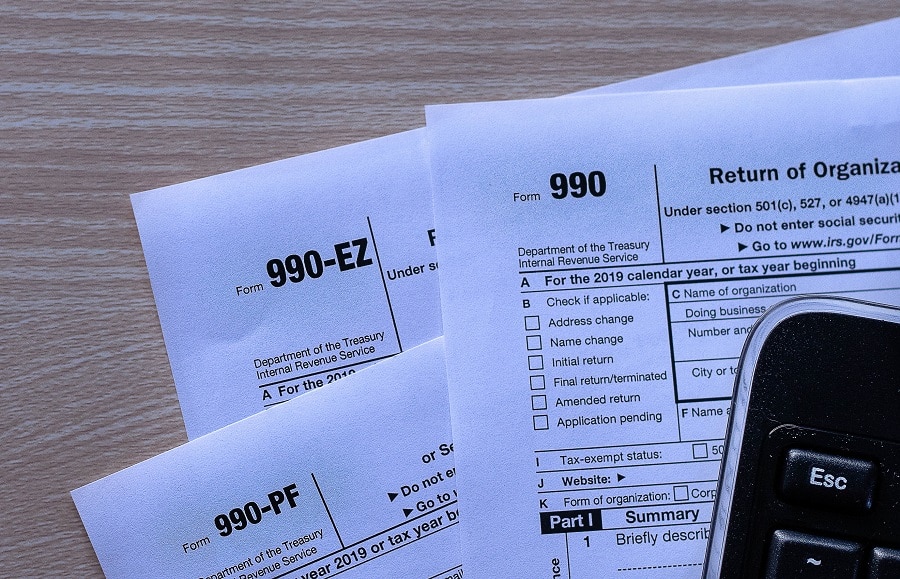

The expanded deadline extensions now apply to many forms and tax payments made by tax-exempt organizations, including:

- Form 990-series annual information returns or notices [Forms 990, 990-EZ, 990-PF, 990-BL, 990-N (e-postcard)]

- Forms 8871 and 8872

- Form 5227

- Form 990-T

- Form 1120-POL

- Form 4720

- Form 8976

Visit the IRS Charities and Nonprofits web page for more information, including a complete list of affected forms, tax payments and other time-sensitive actions. The IRS has also posted a FAQs page to address many common tax filing and payment issues.

Additional questions and comments can be directed to Bob Grossman or Don Johnston at 412-338-9300.

Related posts:

IRS Extends Due Date for Estate and Gift Taxes

Additional Guidance on Extension of Federal Tax Return Due Dates