The Internal Revenue Service confirmed on May 6, 2020, that deceased taxpayers are not eligible for the coronavirus stimulus payment checks (economic impact payments) issued under the CARES Act. The confirmation was presented in the addition of two questions (#10 and #41) in the Internal Revenue Service’s Economic Impact Payment Information Center.

This determination is opposite the position taken by the Service in 2008 when the government issued similar stimulus checks to millions of Americans, with a substantial number going to persons who had died. At that time, a return of those monies was not mandated by the Service.

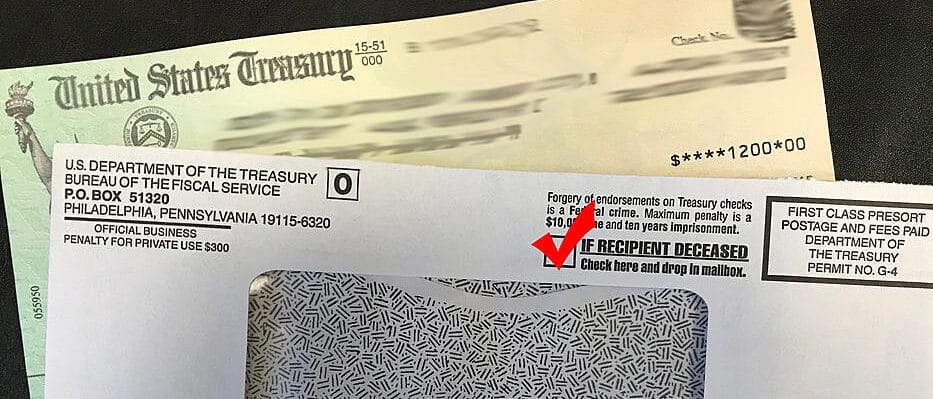

While the government has been trying to minimize circumstances where decedents inappropriately receive a check by cross-reference to records maintained by the Social Security Administration, they do not have “real-time” information regarding the date of death for taxpayers. This problem is worsened by the pandemic itself, which has taken more than 65,000 lives since early March. As such, a certain number of decedents will inevitably receive payments.

While there is no statutory language in the CARES Act that disallows payments to deceased individuals, the Internal Revenue Service has clarified that taxpayers who have died are ineligible to receive checks (FAQ#10) and mandated the return of those checks (FAQ#41). The official IRS Notice comes on the heels of statements made in recent days by President Trump and Secretary of the Treasury Mnuchin, who both indicated that the monies should be returned.

There is immediate concern by as to whether the Internal Revenue Service has the authority to bar receipt of the stimulus checks by decedents, and momentum is building in Congress to make some additional legislative modification. Speculation on future action includes the potential reversal of this IRS directive through the addition of a provision in the stimulus package currently being drafted in the House of Representatives by the Ways and Means Committee.

If you have questions or need assistance, please contact Bob Grossman or Don Johnston or your GYF Executive at 412-338-9300.

Related Posts: