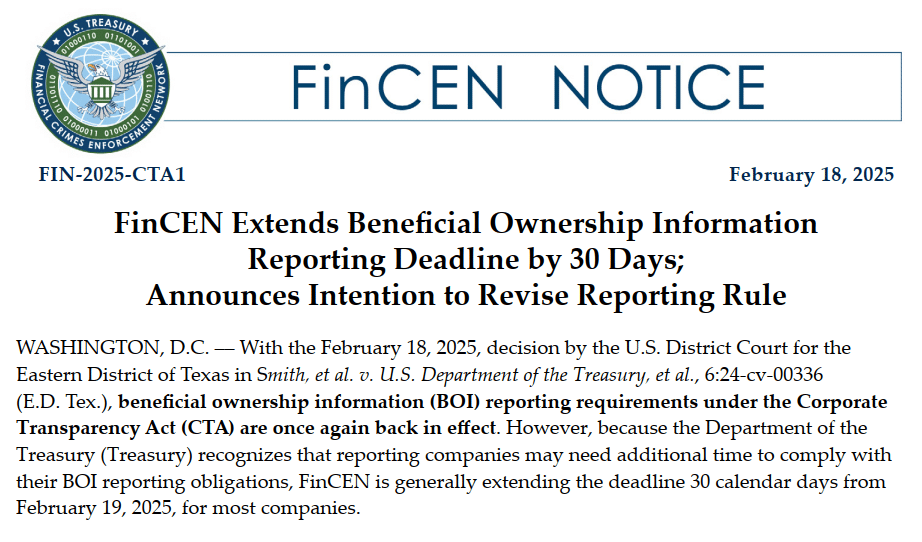

Once again, the Corporate Transparency Act (CTA) reporting requirements are back in effect. As of January 27, 2025, reporting companies were no longer required to file Beneficial Ownership Information (BOI) reports with FinCEN (see recent post). However, a federal district court lifted the last nationwide injunction on February 18, 2025. – Smith, et al. v. U.S. Department of the Treasury, et al., 6:24-cv-00336 (E.D. Tex.) As a result, the BOI filing deadline has been reinstated. Most reporting companies will have until March 21, 2025, to file.

See the FinCEN Notice for more information

Resources:

Subscribe to Receive FinCEN Updates

FinCEN BOI Informational Brochure

FinCEN BOI Informational Videos

Small Entity Compliance Guide for BOI Reporting Requirements

Related Posts:

FinCEN BOI Filing Is Not Required Amid a Flurry of Year-End Rulings

ALERT: BOI Filing Requirements Restored with Extended Deadlines

UPDATE: Temporary Suspension of FinCEN BOI Filing Deadline

FinCEN BOI Filing Deadline is Rapidly Approaching

Federal CTA – Beneficial Ownership Reporting – Updates to FAQs