GYF’s Business Valuation & Litigation Support Services Group continues to monitor economic conditions. As of June 30, 2025, the U.S. economy presents a picture of cautious resilience amid evolving domestic and international headwinds.

Economic activity has slightly contracted, and inflation is ticking up slightly, partially due to tariff policies. Labor markets remain tight yet stable, with modest job growth concentrated in health care and state government. While tariffs and other executive actions have caused market volatility and uncertainty, increased foreign negotiations and trade deals may lead to economic sustainability and predictability. Investor sentiment and consumer confidence have strengthened despite slightly tighter economic conditions than seen in the first quarter of 2025. Increased non-residential building and warehouse activity, driven by key industries in healthcare and data centers, supports a cautiously optimistic economic outlook.

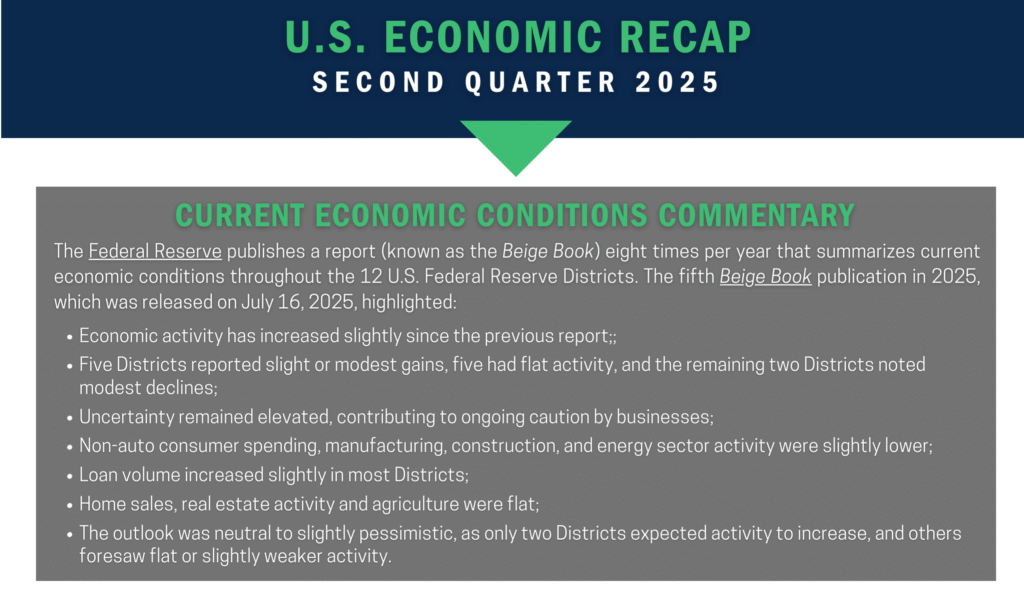

Overall, while the potential for policy-driven disruptions remain high, the fundamental economic environment continues to support a stable valuation context, particularly for businesses closely tied to domestic markets and essential services. Continued monitoring of trade negotiations, monetary policy, and inflation will be essential for forward-looking investment and valuation decisions. For more details about Q2 of 2025, download our Economic Recap.