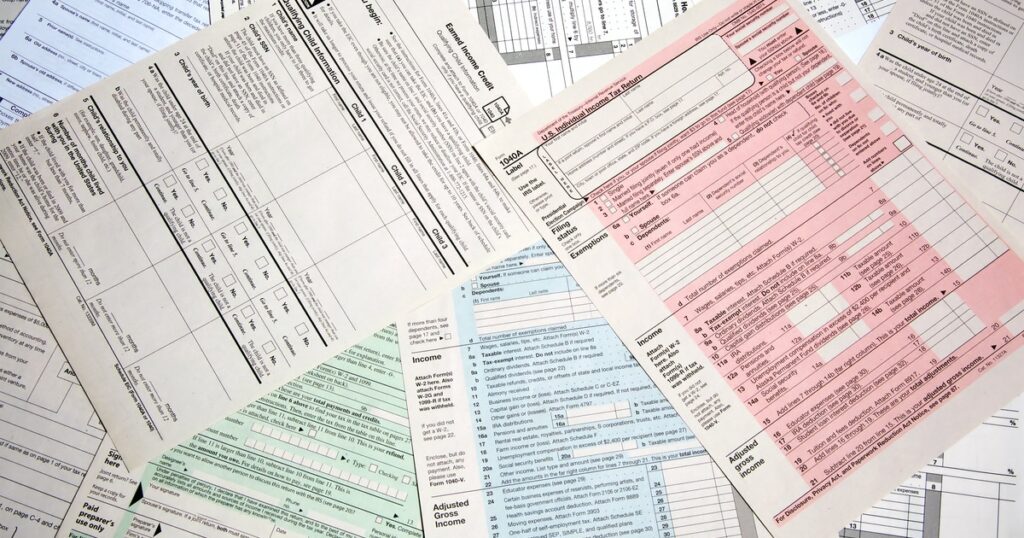

During my internship in GYF’s tax group this summer, I quickly realized how overwhelming the world of tax documentation can be. I came in with a basic understanding of income taxes, but once I started working with actual returns, I saw how many different forms and schedules were involved, and how each one told a different part of the taxpayer’s story.

I found it fascinating how a single form could reveal so much about someone’s finances, so I decided to create this resource that would help other interns feel more confident navigating the many documents.

This “Top 10” list breaks down commonly used tax documents, what they mean, and why they’re important. Whether you’re preparing returns or just trying to understand the language, this guide will provide you with important information.

1. Form 1040: The Bread and Butter of Individual Tax Returns

Think of Form 1040 as the main stage of tax season. It’s where individuals report their income, claim deductions and credits, and calculate how much they owe, or what they’re getting back.

What’s on it:

- Filing status and personal information

- Income from wages, investments, etc.

- Adjustments, deductions, and tax credits

- Final tax liability or refund

2. Form W-2: Your Paycheck

Employees will receive a W-2 from their employer. This form shows how much the employee earned and how much tax was withheld.

What’s on it:

- Total wages, tips, and compensation

- Federal, state, and local taxable wages and taxes withheld

- Social Security and Medicare contributions

- Employer and employee details

3. Form 1099: Earnings Outside Traditional Employment

Sole proprietors, freelancers, investors, prize winners, and many others get 1099s. These forms report income recognized from sources other than as compensation for services provided to an employer.

What’s on it:

- Interest income from banks

- Dividend income from stocks

- Miscellaneous income

- Nonemployee compensation

- Capital gains/losses

4. Schedule A: The Tax Cutter

Instead of taking the standard deduction, some taxpayers may benefit from itemizing their deductions. This occurs when a taxpayer’s total itemized deductions exceed the standard deduction. Itemizing a deduction on Schedule A means to list out and claim specific eligible deductions to further reduce taxable income.

Itemized Deductions:

- Medical and dental expenses

- Mortgage interest

- Charitable donations

- State and local taxes (Potentially up to $40,000 due to OBBBA)

5. Schedule C: For the Self-Employed

Sole proprietors, freelancers, and consultants use Schedule C to report their business income and expenses.

What’s on it:

- Gross receipts or sales

- Business expenses

- Net profit or loss

- Vehicle and home office deductions

6. Schedule D: Gains, Losses, and the Stock Market

Taxpayers who have sold stocks, cryptocurrency, or other investments are required to report capital gains and losses on Schedule D.

What’s on it:

- Short-term and long-term gains/losses

- Cost basis and sale price

- Carryover of capital losses

- Capital gains/losses from Form 1099 reported here

7. Form 1065: Howdy Partner(ships)

Partnerships are required to file Form 1065 to report their income and expenses, which are then passed on to the partners to report on the partners’ income tax returns.

What’s on it:

- Business income and deductions

- Schedule K: Reports ordinary business income from Form 1065/1120S and includes interest income, capital gains/losses, and Section 179 Deduction

- Schedule K-1: Allocates the income/loss amounts from Schedule K to each partner

- Balance sheet and reconciliation

8. Form 1120S: The S-Corp Storyboard

Similar in some respects to partnerships, S corporations use Form 1120S to report their financial activity, which also passes through to the shareholders of the S corporation to report on the shareholders’ income tax returns.

What’s on it:

- Corporate income and expenses

- Schedule K: Reports ordinary business income from Form 1065/1120S and includes interest income, capital gains/losses, and Section 179 Deduction

- Schedule K-1: Allocates the income/loss amounts from Schedule K to each partner

- Balance sheet and reconciliation

9. Form 941: Payroll Tax Reporting

Employers file Form 941 quarterly to report payroll taxes they have withheld and paid.

What’s on it:

- Wages paid to employees

- Federal income taxes withheld

- Social Security and Medicare taxes

- Adjustments for sick pay and tips

10. Document W-4: The Withholding Blueprint

Often when someone starts a new job, they fill out a W-4 to tell their employer how much federal income tax to withhold from their paycheck.

What’s on it:

- Filing status

- Number of dependents

- Additional withholding requests

Final Thoughts to Consider

These forms make up the building blocks for tax prep. As an intern, you won’t understand every line, but exposure to the tax forms will guide you towards preparing returns and asking better questions.

Looking back, one of the most surprising things I learned was how much strategy goes into tax planning. It’s not just about plugging numbers into boxes – it’s about understanding how different forms interact and how choices made throughout the year affect the final outcome.

I still have a lot to learn, but working with these forms gave me a solid foundation and sparked a genuine interest in tax law and financial systems. If you are an aspiring tax intern, I hope this guide helps you feel a little more prepared and a lot less intimidated.