The Coronavirus Aid, Relief and Economic Security (CARES) Act as well as the Families First Coronavirus Response Act (FFCRA), both enacted in March, 2020, provide employers with substantial incentives that are realized through payroll tax reductions. To properly determine the economic value of these incentives, it is necessary to modify historical payroll deposit procedures. Ultimately, the proper determinations will be reflected on each employer’s payroll tax returns.

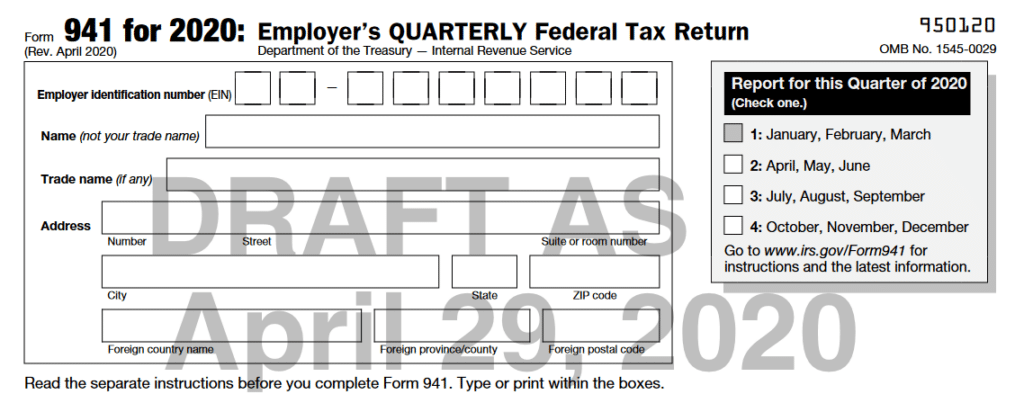

To accomplish the incorporation of the various incentive programs into payroll tax compliance process, the Internal Revenue Service has released a draft of the revised Form 941, Employer’s Quarterly Federal Tax Return and its instructions for 2020. The revised form should be used starting with the second quarter of 2020 (April 1 to June 30).

As expected, the form reflects significant changes to allow for the reporting of new employment tax credits and other tax relief related to COVID-19. For example, the new credit for qualified sick and family leave wages is reported on line 11b and, if applicable, line 13c. The new employee retention credit is reported on line 11c and, if applicable, line 13d.

There also are new lines to report (1) the deferred amount of the employer’s share of Social Security tax during the calendar quarter and (2) total advances received from filing Form 7200 (Advance Payment of Employer Credits Due to COVID-19) for the quarter.

It would be our expectation that most of our clients will look to their third-party payroll services to ensure the new forms are properly prepared. However, because the incentives offered by these two new laws can be extremely large and as they directly affect entity cash flows immediately, we strongly suggest that those individuals within your organization that are responsible for payroll be familiar not only with the form, but also the expected cash flow implications of those incentives the Company has elected to utilize. We also suggest that management be aware of the information on these filings to ensure that those cash flows expected are actually realized.

Questions and comments can be addressed to your Grossman Yanak & Ford LLP executive at 412-338-9300.

Related Posts:

Employers Returning PPP Funds Qualify for the Employer Retention Credit

IRS Releases Guidance on Employee Retention Credit

CARES Act Stimulus Bill Becomes Law

Start Date Set for FFCRA Employment Tax Credits

President Trump Signs Novel Coronavirus Relief Bill Into Law