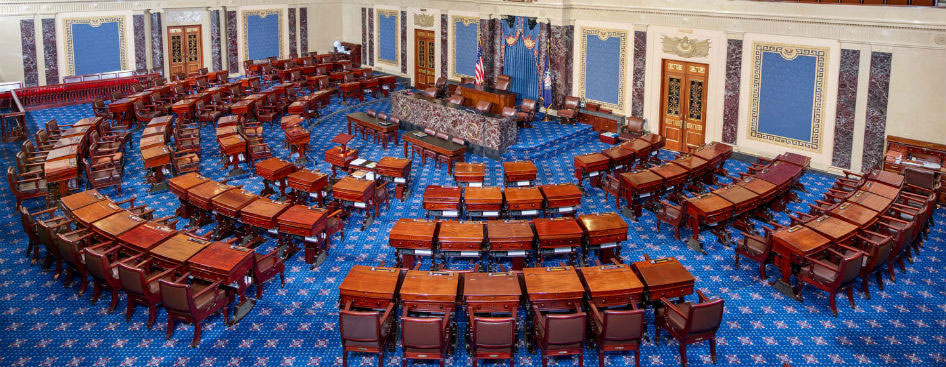

In a late Friday night vote (actually, early Saturday morning, December 2) the U.S. Senate voted to approve the Senate Finance Committee’s modified version of the 2017 tax reform package, the Tax Cuts and Jobs Act (H.R.1). The bill passed with a two-vote margin, wholly along party lines reflecting the Republican majority currently in the Senate. The House version of this bill had been previously approved by that Chamber of Congress.

Click here to read the approved Senate bill

Click here to read the bill passed by the House

The Senate vote marks an important milestone toward achieving the goal of getting a tax bill to the oval office before the Christmas holiday. The next step will involve a reconciliation of the two separate bills produced by the House and the Senate, with the hope of ironing out the differences before sending a single bill to both Chambers for a final vote, and then on to the President. This process involves selected members of the House Ways and Means Committee and the Senate Finance Committee who will work to develop that single bill.

While there are, of course, differences in the two versions of the bill, there are also many similarities, which would lead one to suspect that the Republican effort to pass tax reform is more likely than not to get through by year end. However, the one key element that must be considered when evaluating the two bills is that many of the changes in the Senate bill are temporary, while the House bill mandates permanent change.

The breadth of these two bills is incredibly broad, given the short time in which the legislation was developed and written. As such, we think any final bill will be so far-reaching that almost every taxpayer, individual and business, will be affected in some way by the bill’s provisions.

The Senate bill amends the Internal Revenue Code to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. A summary of the provisions of the bill, as published on the Congressional website, are below.

With respect to individuals, the bill:

- replaces the existing tax brackets (10%, 15%, 25%, 28%, 33%, 35%, and 39.6%) with new tax brackets (10%, 12%, 22%, 24%, 32%, 35%, and 38.5%);

- increases the standard deduction;

- suspends the deduction for personal exemptions;

- allows a deduction for business income of pass-through entities (i.e., partnerships, S corporations, limited liability companies, sole proprietorships);

- increases the child tax credit and allows a credit for dependents who are not children;

- suspends the deduction for state and local taxes not incurred in carrying on a trade or business or an activity for the production of income;

- suspends the deduction for home equity loan interest;

- repeals the penalty for individuals who fail to maintain minimum essential health coverage as required by the Patient Protection and Affordable Care Act (commonly referred to as the individual mandate);

- suspends the overall limitation on certain itemized deductions;

- suspends the alternative minimum tax for individuals; and

- doubles the basic exemption amount for the estate, gift, and generation-skipping transfer taxes.

Many of the provisions in the bill that affect individual taxpayers expire after 2025.

For businesses, the bill:

- permanently reduces the corporate tax rate from a maximum of 35% to a flat 20% rate,

- allows increased expensing of the costs of certain property,

- repeals the deduction for income attributable to domestic production activities,

- modifies the net operating loss deduction,

- limits the deductibility of net interest expenses to 30% percent of the business’s adjusted taxable income, and

- modifies the taxation of foreign income.

The bill also: (1) repeals or modifies several additional credits and deductions for individuals and businesses, (2) directs the Department of the Interior to implement an oil and gas leasing program for the Coastal Plain of the Arctic National Wildlife Refuge (ANWR) in Alaska, and (3) directs the Department of Energy to draw down and sell oil from the Strategic Petroleum Reserve.

Grossman Yanak & Ford LLP continues to break down the tax bill and expects to have a full Tax Alert available in the near future. In the interim, should you have any specific comments or questions, please feel free to contact Bob Grossman or Don Johnston at 412-338-9300.

See Related Posts:

ACA Individual Mandate Repeal Included in Revised Senate Tax Reform Package

Tax Reform Moves Forward in Both Chambers of Congress

Ways and Means Committee Approves Amended Tax Reform Bill

Tax Reform Bill Marches Forward