The Consolidated Appropriations Act, 2021 (CAA) and the Economic Aid Act, set forth therein, have extended and expanded the Employee Retention Credit (ERC) affording many taxpayers yet another avenue of realizing cash flow increases due to lower payroll tax obligations during the COVID-19 pandemic. (see related post). While the law and Treasury have provided reasonably strong guidance on the inter-workings of the credit, we are seeing a number of inquiries as to how best to apply the law to obtain the actual refunds.

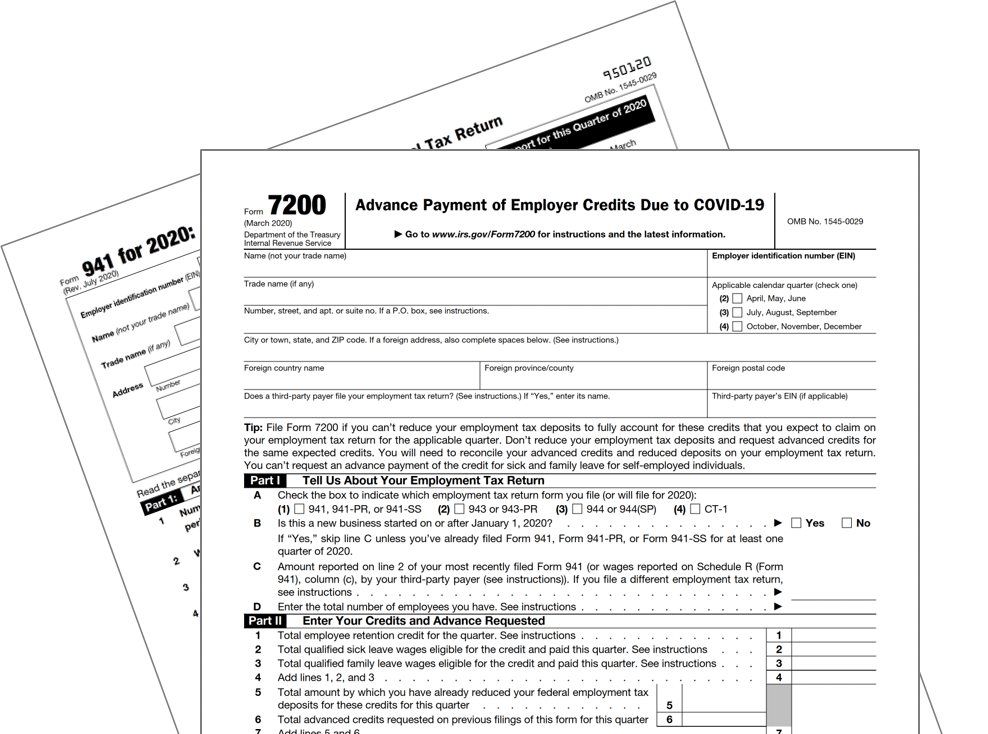

To address this credit (as well as other initiatives offered by the 2020 stimulus packages) and its refundability, the Internal Revenue Service has taken two major steps to facilitate the mechanical proces needed to utilize the credits and get any refunds due. The first action was the creation of a new “optional” Form 7200, which allows for claiming advanced refunds of payroll taxes that may not be required if the employer qualifies for the credit. Additionally, the Service has issued a revised 2020 version of the Form 941, Employer’s Quarterly Federal Tax Return.

New Form 7200 – Advance Payment of Employer Credits Due to COVID-19

Form 7200 is a completely new form developed and issued in response to government economic initiatives included in the CARES Act, enacted on Mach 27, 2020. The form is used to request an advance payment of qualifying tax credits resulting from COVID-19 stimulus initiatives. This form also provides a means to obtain an advanced refund of payroll taxes that applicable employers would otherwise have been required to remit to the Internal Revenue Service in the future had it not been for the credits.

These tax credits including the ERC, will be reported on employers’ quarterly payroll tax reports, Forms 941. Form 7200 is used when you want an advance on these credits, not when the net of payroll taxes due minus credits results in a remaining amount due to Internal Revenue Service.

Employers may file Form 7200 as often as every payroll, or not at all. Employers should calculate payroll taxes, deduct payroll tax payments, and deduct qualifying tax credits. If the result is a credit, they may file form 7200 to receive their refund in advance or, alternatively, they may claim a refund on Form 941. If using Form 7200, filing is due no later than the quarterly due date for Form 941.

It should be noted that Form 7200 is offered as a convenience and not a required filing. Employers are not required to file Form 7200.

Example

If an employer is entitled to a $7,000 ERC and its payroll tax deposit for that pay period for all employees is $8,000, the employer is only required to deposit $1,000 on its next regular deposit date, generally 3 business days after pay date.

Additionally, if an employer is entitled to a credit for qualified sick leave and ERC wages totaling $12,000, and the payroll tax liability for that pay date is $9,000 in payroll taxes on all employees, the employer could file Form 7200 and claim the refundable credit of $3,000 ($12,000 in payroll taxes, minus $9,000 in credits).

Note, however, if an employer does not file Form 7200 to claim the credits each payroll, these credits may still be refunded on Form 941 if the net of payroll taxes due, minus payments made and credits due, result in a credit.

Filing & Refund Processing

The Internal Revenue Service is only accepting Form 7200 by fax (855-248-0552), and no paper mailings will be accepted. For employers using a payroll processor, the Internal Revenue Service will allow the payroll processor to fax Form 7200 if the employer has authorized the payroll provider to do so using Form 8655, Reporting Agent Authorization.

All employers who want their payroll processor to sign and file Form 7200 must provide a written authorization specifically requesting the payroll provider file and sign Form 7200. This can be done by mail, email, or fax. A copy of the authorization should be maintained by the employer.

Direct deposit of any refunds due is not an option. All credits are refunded by check, and no timeframe has been provided for mail-time of refunds. However, the Internal Revenue Service issued a statement on December 4, 2020, noting that delays in the refunds are likely:

“Employers will experience a delay in receiving payments associated with Form 7200, Advance Payment of Employer Credits, processed between late-December and mid-January due to standard end-of-year close out. The IRS will continue to accept and process valid Forms 7200 during this time, and the payment of valid requests during this time will begin to be processed on January 21, 2021. Employers will still receive Letter 6312, Form 7200 Response, if the Form 7200 cannot be processed.”

Revised Form 941 – Employer’s Quarterly Federal Tax Return

The Internal Revenue Service has also modified the Form 941 for 2020. Form 941 is now three pages in length and has been published for final for use by taxpayers.

Revisions included on Pages 1 and 2 of the new Form 941, relate to qualified sick/family/medical leave wages, reporting of nonrefundable portion of credit for qualified sick/family/medical leave and ERC wages, the deferred amount of employer share of social security tax, refundable portion of credit for qualified sick/family/medical leave and ERC wages, and total advances received from filing Form(s) 7200 for the quarter.

Page 3 of Form 941 now asks for additional information regarding qualified health plan expenses allocable to qualified sick/family leave wages, qualified wages for the ERC and health plan expenses allocable to ERC wages.

Final Thoughts

Filing taxpayers should document their calculations for credits and keep copies of completed Form(s) 941 and 7200. Should you have questions or comments on the mechanics of obtaining these benefits, please feel free to contact Bob Grossman, Don Johnston or Mike Weber at 412-338-9300.

Related posts:

Consolidated Appropriations Act, 2021, Enhances the ERC

Retroactive and Expanded Employee Retention Credit Opportunities

President Signs Massive Stimulus and Government Spending Bill Into Law