The Small Business Administration (SBA), in consultation with the U.S. Department of Treasury released their Paycheck Protection Program (PPP) loan forgiveness application on Friday, May 15, 2020. Included with the application are detailed instructions for completion of the form, which add clarification to many questions borrowers have been asking with respect to the forgiveness aspects of the loan. The PPP loans were authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The release also notes that the SBA will also soon issue additional regulations and guidance to further assist borrowers as they complete their applications, as well as provide lenders with guidance as to their responsibilities in the loan forgiveness process under the CARES Act.

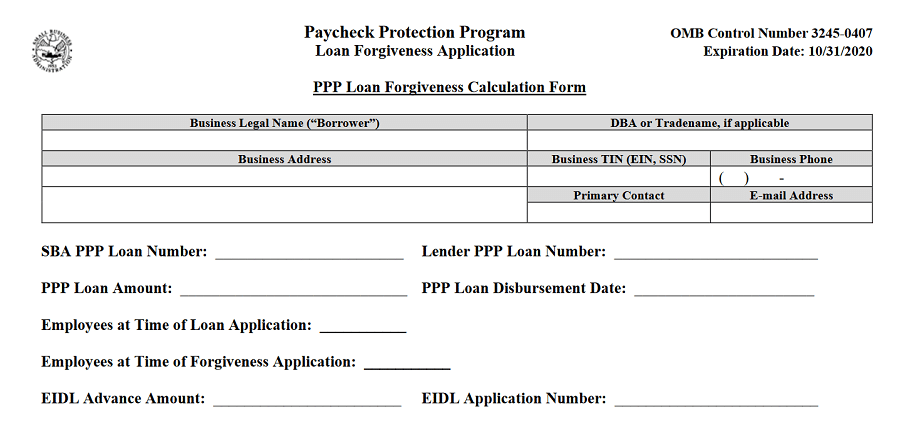

The application, itself, contains four specific components. These include:

- The PPP Loan Forgiveness Form

- The PPP Schedule A

- The PPP Schedule A Worksheet

- The (optional) PPP Borrower Demographic Information Form

The SBA requires submission of components 1 and 2.

Borrowers have the choice to either complete the Form themselves and then submit it to their lender, or complete the Form electronically through their lender.

Key Considerations

While certainty for all aspects of this process will have to wait until these final regulations and guidance are issued, the instructions to the application do provide some key information that borrowers should consider. A number of these key elements include:

Alternative Payroll Covered Period

The instructions provide an “Alternative Payroll Covered Period” as an administrative convenience.

Under the definition to this term, borrowers with a biweekly (or more frequent) payroll schedule may elect to calculate eligible payroll costs (i.e., covered payroll costs) using the eight-week (56-day) period that begins on the first day of their first pay period following their PPP Loan Disbursement Date.

Under the general rule for the covered period, the beginning date had been the date the original loan proceeds were received. This change in the definition of the covered period adds flexibility for employer/borrowers and goes a long way in easing covered payroll costs administration for both employers and lenders.

Inclusion of Rent or Lease Payments as Covered Non-Payroll Expenses

Not addressed in the CARES Act, or earlier guidance, the instructions note that rent or lease payments for real “or personal property” are included in the calculation of covered non-payroll expenses so long as the lease agreements were in place prior to February 15, 2020.

The instructions add that borrowers are not required to report payments that they do not wish to have considered in the forgiveness amount.

This is an important provision in that it again allows for flexibility in how borrowers complete the application to ensure maximum loan forgiveness.

Clarification of Eligible Payroll Costs

Language in the section of the instructions titled, “Summary of Costs Eligible for Forgiveness” clarifies that both eligible payroll costs and eligible non-payroll costs include both costs that are “paid” within the covered period or “incurred” during the covered period and paid on or before the next regular payroll date (for payroll costs) or the next regular billing date (for non-payroll) costs, even if that billing date is after the covered period.

Required Representations/Certifications

The application contains seven representations and certifications that must be initialed by the borrower or its representative and signed, under risk of civil and/or criminal penalty and later pursuit of collection by the federal government.

About the Application

Note that the application, itself, is just four (4) pages long. The PPP Schedule A and PPP Schedule A Worksheet Tables are simply schedules designed to navigate the actual technical calculation requirements supporting the application.

The noteworthy clarifications included in the Schedule A and its worksheet instructions are as follows:

- The instructions explain “Average Full-Time Equivalency” (FTE) as that term as used throughout the CARES Act and in later FAQs issued by the SBA and Treasury. The calculation of full-time equivalency during the covered period or the alternative Payroll Covered Period is 40 hours per week. There is also a computation for anyone working less than 40 hours per week as a .5 FTE.

- Finally, the PPP Schedule A Loan Forgiveness Calculation Form instructions provides a list of documents that are suitable to serve as evidence of the information provided and that are required to be remitted to the lender with the application. These include documents for Payroll, FTEs, and Non-Payroll Costs. A second document listing notes information that is required to be maintained by each employer/borrower, but is not required to be submitted to the lender.

- The instructions note that all records supporting information in the application for loan forgiveness must be held for six years.

The last element of the released information is voluntary and is intended to collect demographic information to aid in understanding who the loan proceeds and the forgiveness benefited across the economy.

More guidance on PPP Loan Forgiveness is expected soon. Additional PPP information can be found in the related posts below or at the SBA PPP website.

Grossman Yanak & Ford LLP continues to monitor developments daily and will include updates in our Coronavirus Resource Center. In the interim, should you have question or comments, please contact Bob Grossman, Don Johnston or Mike Weber at 412-338-9300.

Related posts:

SBA Releases Good News for PPP Loan Borrowers Under $2 Million

Further SBA Guidance Extends Safe Harbor Deadline for SBA Loans

New SBA Guidance on PPP Loan Forgiveness Related to Laid-Off Employees

Paycheck Protection Program Loans – Round 2

FAQs Issued to Further Clarify Guidance on PPP Loans

Paycheck Protection Program Loans (PPP) Available Under the CARES Act