President Trump has signed the Taxpayer First Act of 2019 (H.R. 3151), which alters the management and oversight of the Internal Revenue Service (IRS) with the aim of improving customer service and the appeals process. The Act also provides new confidentiality safeguards as taxpayers interact with the IRS.

The Taxpayer First Act includes provisions that:

- establish the IRS Independent Office of Appeals to resolve federal tax controversies without litigation;

- require the IRS to develop comprehensive customer service and IRS personnel training strategies;

- exempt certain low-income taxpayers from payments required to submit an offer-in-compromise;

- modify certain tax enforcement procedures and requirements;

- establish requirements for responding to Taxpayer Advocate Directives;

- establish a Community Volunteer Income Tax Assistance Matching Grant Program;

- require the IRS to give public notice of the closure of taxpayer assistance centers;

- modify procedures for whistle-blowers;

- establish requirements for cybersecurity and identity protection;

- provide notification to taxpayers of suspected identity theft;

- require the appointment of a Chief Information Officer who shall develop and implement a multiyear strategic plan for IRS information technology needs;

- modify requirements for managing IRS information technology;

- expand electronic filing of tax returns;

- prohibit the rehiring of certain IRS employees who were removed for misconduct;

- require mandatory e-filing by tax-exempt organizations and notice before revocation of tax-exempt status for failure to file; and

- increase penalties for failure to file tax returns.

The Taxpayer First Act also requires the IRS to implement:

- an Internet platform for Form 1099 filings,

- a fully automated program for disclosing taxpayer information for third-party income verification using the Internet, and

- uniform standards and procedures for accepting electronic signatures.

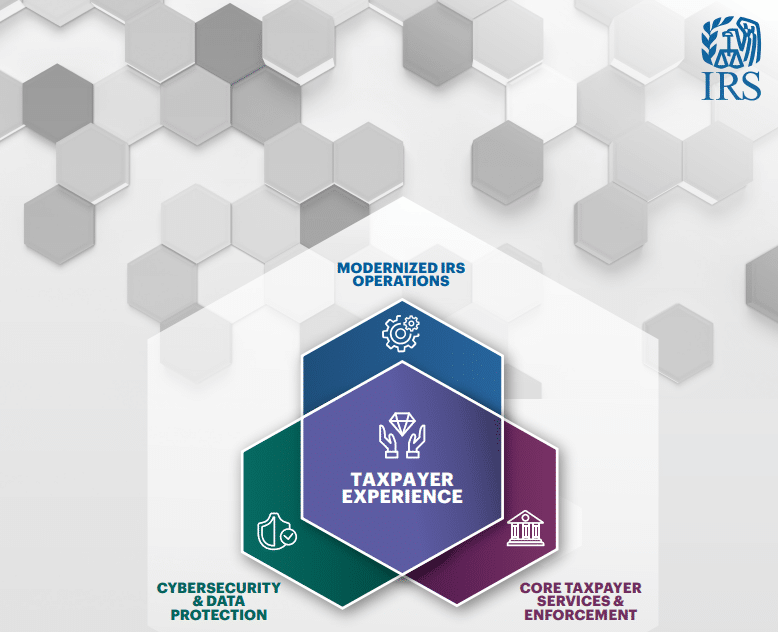

Additionally, an important provision of the Act requires the Treasury Department to submit to Congress by September 30, 2020, a comprehensive written plan to redesign the Agency. This plan must:

- streamline the structure of the agency, including minimizing the duplication of services and responsibilities;

- best position the IRS to combat cybersecurity and other threats to the agency; and

- address whether the IRS’s Criminal Division should report directly to the Commissioner.

Beginning one year after the plan is submitted, the IRS’s current structure, which features operating units that serve particular groups of taxpayers with similar needs, will cease to apply. H.R. We expect this reorganization to be a positive development as many of the organizational protocols at the Internal Revenue Service are sorely outdated.

The IRS has already begun working on its plans to update and improve its infrastructure, and issued an Integrated Modernization Business Plan in April 2019.

Please contact Bob Grossman or Don Johnston at 412-338-9300 if you have questions or need additional information.

Related Posts:

Taxpayer Advocate Report Released

Annual Tax Data Book Released by the Internal Revenue Service