Paycheck Protection Program Loans – Round 2

After getting hung up for several weeks in the Senate, on April 24, 2020, President Trump signed the Paycheck Protection

After getting hung up for several weeks in the Senate, on April 24, 2020, President Trump signed the Paycheck Protection

Generating financial statements is a routine part of the close process, but standard financial reports cannot always provide sufficient explanations

The IRS issued Rev. Proc. 2020-25 on April 17, 2020, providing guidelines for how taxpayers can take advantage of the

On April 9, 2020, the Internal Revenue Service and Treasury issued additional guidance to specifically address the new net operating

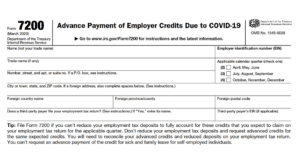

In deference to fairness, on April 9, 2020, the Internal Revenue Service issued Notice 2020-23, which extended the tax filing

In the flurry of releasing millions of dollars of loan requests from small businesses under the CARES Act’s Paycheck Protection

There has been a flood of information (and misinformation) about the Paycheck Protection Program (PPP) included in the Coronavirus Aid,

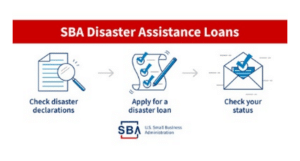

There are numerous relief programs available to small business owners negatively impacted by the Coronavirus pandemic. We have previously posted

As with nearly all of the guidance being issued regarding the COVID-19 relief programs, information regarding the Paycheck Protection Program

On April 1, 2020, the U.S. Department of the Treasury and the Internal Revenue Service announced that Social Security beneficiaries

Internal Revenue Service guidance on various aspects of the recently passed economic stimulus bills continues to be released on a

With all of the commentary and focus on the potentially-forgivable Paycheck Protection Program loans included in the Coronavirus Aid, Relief

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_gtag_UA_60038340_2 | 1 minute | This cookie is installed by Google Analytics The cookie is used to throttle the request rate. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visited in an anonymous form. |