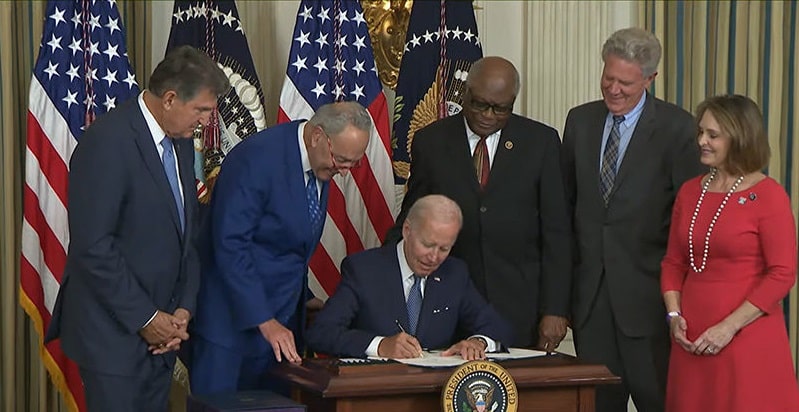

A remnant of the original Build Back Better Plan, the Inflation Reduction Act of 2022 (IRA) was signed into law by President Joe Biden on August 16, 2022. The newly signed law has been touted primarily for its measures to make healthcare/prescription drugs more affordable and to combat climate change. Additionally, the IRA also contains key tax provisions that will impact certain large businesses. This post reviews some of those changes.

Corporate Minimum Tax

The bill brings back the Corporate Alternative Minimum Tax (AMT), albeit in a revised fashion. The new law will impose a 15% minimum tax that will be calculated on a corporation’s “adjusted financial statement income,” reduced by a corporate AMT foreign tax credit. Adjusted financial statement income is the net income or loss that is reported by a corporation on its applicable financial statement to investors. This amount can differ vastly from what the corporation reports as its taxable income for a given tax year on its tax return.

This tax would be applicable only to very large corporations – those with average book income of greater than $1 billion for the previous three consecutive tax years. The requirement is decreased to $100 million for certain corporations that have foreign parents. The updated AMT will be effective starting in tax years beginning after December 31, 2022, and is expected to apply to more than 200 companies.

IRS Funding Increase

In order to pay for such a large bill, Washington is looking to help close the “tax gap,” which is the difference between what should be collected annually by the IRS compared to what is actually collected. To the dismay of the AICPA, the bill allocates $80 billion to the IRS over 10 years, whereas only $3.18 billion is being put towards taxpayer services, with about half of this $80 billion being used for enforcement actions.

This increase in IRS funding does not coincide with any change to the Internal Revenue Code. The money from the bill simply aims to expand IRS enforcement and is expected to raise $124 billion in revenue, per the Congressional Budget Office. One can surmise that this $124 billion revenue raise will come from the IRS being able to reduce the “tax gap.”

Significant skepticism exists as to the ability of the IRS to pull this off (i.e., spend money to make money) and if so, why not spend more to save more? Does this mean that the IRS will perform more audits and catch more “cheaters”? How soon will the IRS be able to increase its workforce and ultimately improve enforcement to generate a favorable return on this $80 billion spend? It will certainly take time for the IRS to hire and train enough agents to perform more audits to catch the “cheaters.”

We all know that the IRS is very understaffed and months behind in performing simple tasks like opening the mail. How long will it take to improve enforcement and start raising revenue? Tracking the success of these lofty goals will be interesting. I will take the under (on the $124M revenue raise) on this one.

Additional Tax Considerations

- Stock Buy-Back Tax – the bill includes a new 1% nondeductible excise tax on corporate stock repurchases, which will take effect at the beginning of calendar year 2023. This tax was added to make up for revenue that would have been made with a provision to close an extended holding period for long-term capital gains treatment of compensatory partnership interests, commonly referred to as carried interests. That carried interest loophole provision was removed from the legislation at the last minute in order to secure enough votes to pass the bill through the Senate. This 1% tax is expected to raise $74 million over 10 years, according to estimates provided by the Democrats.

- SALT Deduction Cap – the bill does not increase the $10,000 cap for the State and Local Tax (SALT) deduction. This deduction allows for itemizing taxpayers to deduct specific taxes that are paid to state and local governments. Several legislators, especially those from high-tax states, had been pushing to raise the cap as part of this legislation. The fact that this cap was not increased is a huge win for taxpayers who live in lower-taxed states because the ability to deduct large state taxes paid on the federal income tax return reduces the ultimate federal income tax that is paid by those living in those higher-taxed states. It is somewhat surprising that the Democrats have not been able to expand or eliminate this cap since taking control of Congress and the White House over the last two years.

- Research Tax Credit Applied Against Payroll Tax for Small Businesses – the research and development (R&D) tax credit that can be applied against payroll taxes was doubled, from $250,000 to $500,000. This refundable credit can be applied against payroll tax for small businesses and covers a variety of expenditures including improvement or development of products, processes, techniques, and software. This change only applies to the portion of the credit that can be used against payroll tax.

- Energy Tax Credits – because a primary focus of this bill is to combat climate change and incentivize renewable energy, it expands the eligibility for and extends the life of tax credits that encourage investment in renewable energy. The legislation includes credits for households to reduce energy costs, extension and adjustment to electric vehicle credits with the intention of reducing carbon emissions, and investments in clean energy production.

The interesting thing about this tax bill is not what is included in it, but what is excluded from the final legislation. There are no individual tax rate increases for higher income earners, nor is there a change to long-term capital gains rates. Additionally, the carried interest rules were not changed in the legislation because a single Senator refused to vote for the bill unless that language was removed. Compared to the original proposals and tax changes, this bill is a mere fraction of the originally publicized changes promised by the Democratic Party.

Within the ever-changing environment of tax law, questions often arise. When they do, it is best to seek the assistance of qualified professionals. Please reach out to Grossman Yanak & Ford LLP at 412-338-9300 for help with changes related to this legislation or any other tax issues.

![]() Noah Trimble, an Intern in GYF’s Tax Services Group, assisted with the research and preparation of this post. Noah is a student at Robert Morris University, working to earn his BS in Accounting as well as an MBA. As a GYF Tax Intern, Noah assists in the preparation of a wide variety of individual and corporate tax returns, gaining knowledge and experience.

Noah Trimble, an Intern in GYF’s Tax Services Group, assisted with the research and preparation of this post. Noah is a student at Robert Morris University, working to earn his BS in Accounting as well as an MBA. As a GYF Tax Intern, Noah assists in the preparation of a wide variety of individual and corporate tax returns, gaining knowledge and experience.