On October 22, 2024, The Internal Revenue Service announced inflation adjustments for the coming tax year of 2025. The adjustments increased the standard deduction, Alternative Minimum Tax (AMT) Exemption, and a few other credits that will benefit American taxpayers.

Single and married filing separate taxpayers will see the standard deduction increase by $400 to $15,000 in tax year 2025. The married filing joint taxpayer standard deductions will rise $800 to $30,000 in tax year 2025. The Head of Household standard deduction will rise $600 to $22,500 in tax year 2025.

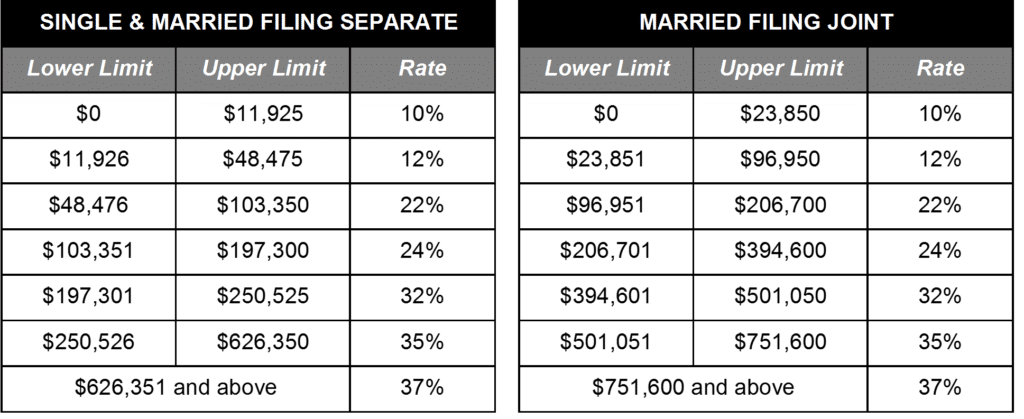

2025 tax rates are detailed below. 37% remains the highest rate for individual taxpayers.

The Alternative Minimum Tax (AMT) tax exemption amounts increase to $88,100 for single taxpayers and $68,650 for married filing separately taxpayers. This exemption amount begins to phase out at $626,350 for both single and married filing separate taxpayers. Married filing joint taxpayers will see an increase in the exemption amount to $137,000 and will begin to phase out at $1,252,700.

The Earned Income Tax Credit will increase for families who have three or more qualifying children from $7,380 in 2024 to $8,046 in 2025.

The Qualified Transportation Fringe Benefit Limitation will increase from $315/month in 2024 to $325/month in 2025.

Health Flexible Spending Arrangements (HSA or FSA) dollar limitation for employee salary reductions will increase $100 to $3,300 in 2025. The carryover for unused amounts in these accounts will increase from $640 in 2024 to $660 in 2025.

Medical Savings Account holders with self-only coverage will see an increase in the minimum annual deductible from $2,800 in 2024 to $2,850 in 2025. The maximum annual deductible cannot exceed $4,300 in 2025, an increase from $4,150 in 2024. The maximum out-of-pocket expense amount for self-only coverage will rise from $5,500 in 2024 to $5,700 in 2025.

Medical Savings Account holders with family coverage will see an increase in the minimum annual deductible from $5,500 in 2024 to $5,700 in 2025. The maximum annual deductible cannot exceed $8,550 in 2025, an increase from $8,350 in 2024. The maximum out-of-pocket expense amount for family coverage will rise from $10,200 in 2024 to $10,500 in 2025.

The Foreign Earned Income Exclusion will rise from $126,500 in 2024 to $130,000 in 2025. This exclusion applies to U.S. resident aliens employed in a foreign country for 330 or more days in a calendar year.

Estate exclusion amounts will increase from $13,610,000 in 2024 to $13,990,000 in 2025 given that a decedent dies in 2025.

Gift exclusion amounts will increase from $18,000 in 2024 to $19,000 in 2025.

Adoption credits for a child with special needs will increase from $16,810 in 2024 to $17,280 in 2025.

Taxpayers who have questions about these adjustments or need assistance with individual tax planning and compliance, should contact the GYF Tax Services Group at 412-338-9300.