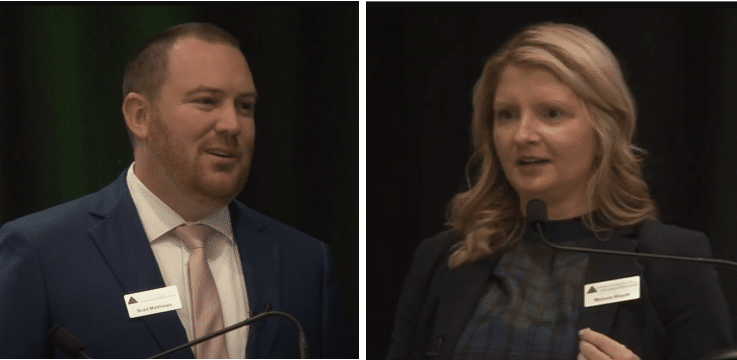

Melissa Bizyak and Brad Matthews presented, from GYF’s Business Valuation Services Group, presented Financial Experts in Litigation at our firm’s annual CPE Day. Discussion topics included typical litigation settings where a financial expert is needed, the role of a financial expert, the partnership between attorneys and financial experts, and independence and objectivity standards.

Types of Financial Experts

Melissa and Brad began by discussing the two different types of financial experts, consulting experts and testifying experts, and provided examples as to when each is needed in a case. It is important to note that experts must comply with professional standards and establish that they have the requisite knowledge, skill, and experience needed to provide an opinion.

Lost Profit Determinations

They then went on to discuss lost profit determinations, specifically how to calculate lost profits. Net lost profits is the difference between lost revenues and avoided costs. There can be many ways to go about calculating lost profits depending on the case, however all calculations should be based upon reasonable, reliable factors supported by sufficient documentation; ultimately, no speculation. To take this further, Melissa explained the four methods used to determine lost revenues and profits: the Before-and-After Method, the Yardstick Method, the Sales Projection Method, and the Market Method. Another factor to consider in all cases is mitigation. The financial expert should consider whether the plaintiff took any reasonable steps to mitigate their damages, thereby reducing the quantity of damages incurred. Mitigation looks different in every case as it is dependent upon the plaintiff’s financial ability to mitigate, the related costs to mitigate, timing issues impacting mitigation, or various other items. In any case, there should be some effort on the Plaintiff’s part to take reasonable mitigation actions as much as possible and therefore should be included in a financial expert’s analysis.

Shareholder Divorce & Shareholder Oppression

After wrapping up lost profits determinations, Brad transitioned into speaking about shareholder divorce and shareholder oppression situations. Shareholder divorce scenarios are typically caused by personal use of business assets, using the business for personal interests, financial distress, or shareholder freeze out. The two types of resolutions include single equity owner buy out, the most common alternative when one shareholder buys out the other, or complete sale of the business. These scenarios can also be resolved in court through arbitration or mediation when an independent party comes in to try to settle the case prior to going to trial. Although extreme, a court can also order a judicial dissolution of the company altogether. With the various avenues shareholder disputes may go, it is critical to engage a qualified business valuation expert. Financial experts can be leveraged to complete a business valuation, to provide forensic accounting services, or to provide general consulting support services. Ultimately, in any shareholder dispute, the shareholder agreement is an authoritative and binding document that will speak to how these situations should be handled.

Standards of Value

To conclude, Melissa and Brad discussed the difference between fair value and fair market value standards. In most states, including Pennsylvania, the fair value standard is used to resolve shareholder disputes. It is important to note that fair value does not always equal fair market value. Overall, the buy-sell agreement (if there is one) and state statues will provide authority as to the standard of value that should be used.

Click here to access copies of the slides, links to resources and a video of the presentation

About GYF’s CPE Day: The firm presents this program each year to bring together clients, friends of the firm, and other professionals who are interested in gaining knowledge. The day is always filled with interesting presentations and great networking opportunities, and is generally attended by 300+ guests. If you have any questions about the material covered, or other issues we did not have time to address, please reach out to your GYF Executive or contact the office at 412-338-9300. We look forward to seeing everyone next year!