GYF 2024 CPE Day Recap – Federal Tax Update

Taxpayers and tax preparers alike will agree that paying taxes is rough – at times, the whole process may seem unnecessarily rough! In keeping with the football theme of our

Stay up to date on the latest in industry and GYF news. Subscribe to have the most recent posts delivered to you.

Taxpayers and tax preparers alike will agree that paying taxes is rough – at times, the whole process may seem unnecessarily rough! In keeping with the football theme of our

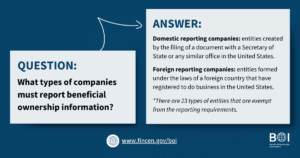

The Federal Corporate Transparency Act (CTA), which was passed in early 2021, requires certain reporting entities to file information about their beneficial owners (i.e., the individuals who ultimately own or

At our firm’s annual CPE Day, GYF had the pleasure of hosting Tomer Borenstein, CTO & Co-Founder of BlastPoint, to discuss ethics and safety considerations relative to Artificial Intelligence (AI).

Though many companies have been investing in crypto assets for several years, the FASB had remained silent on the matter until December 2023 when it issued ASU 2023-08. Until adoption

Early this year, the Internal Revenue Service rolled out a new program called Direct File, a free tax tool that eligible taxpayers can use to file their federal taxes directly

On October 22, 2024, The Internal Revenue Service announced inflation adjustments for the coming tax year of 2025. The adjustments increased the standard deduction, Alternative Minimum Tax (AMT) Exemption, and

In June of 2021, the world of college athletics saw a drastic shift when the NCAA decided that college athletes could begin using their name, image, and likeness (NIL) as

Grossman Yanak & Ford LLP has been named again as one of Pittsburgh’s “Top Workplaces” and is pleased to note that we have been recognized for all 14 years of

GYF’s Business Valuation & Litigation Support Services Group continues to monitor economic conditions. The outlook of the U.S. economy at the end of Q2 2024 is being viewed as cautiously

It is important for individuals who want to start a new business to understand the taxation considerations related to a new company. This post will review the different organization options

As explained in a previous blog post, the Federal Corporate Transparency Act (CTA), which was passed in early 2021, requires certain reporting entities to file beneficial ownership information (BOI) reports

With its outdated net operating loss (NOL) limitation provisions, Pennsylvania has lagged behind the rest of the country for far too long in terms of providing its businesses a fair

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_gtag_UA_60038340_2 | 1 minute | This cookie is installed by Google Analytics The cookie is used to throttle the request rate. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visited in an anonymous form. |