NOL Procedures Under the CARES Act Offer Tax-Saving Opportunities

The rules for business net operating losses (NOLs) have undergone several changes in recent years. Under the tax reform law

The rules for business net operating losses (NOLs) have undergone several changes in recent years. Under the tax reform law

The Small Business Administration (SBA) and Treasury issued more FAQs related to PPP loans on August 11, 2020. Additional information

Prior to the enactment of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, many taxpayers meeting the specified age

So much has been written about Paycheck Protection Program loans since the Coronavirus Aid, Relief, and Economic Security (CARES) Act

On June 5, 2020, President Trump signed the Paycheck Protection Program Flexibility Act of 2020 (H.R. 7010) into law. The

The House of Representatives overwhelmingly approved the Paycheck Protection Program Flexibility Act (H.R. 7010) on May 28, 2020. The bill

The IRS issued Rev. Proc. 2020-25 on April 17, 2020, providing guidelines for how taxpayers can take advantage of the

On April 9, 2020, the Internal Revenue Service and Treasury issued additional guidance to specifically address the new net operating

There has been a flood of information (and misinformation) about the Paycheck Protection Program (PPP) included in the Coronavirus Aid,

On April 1, 2020, the U.S. Department of the Treasury and the Internal Revenue Service announced that Social Security beneficiaries

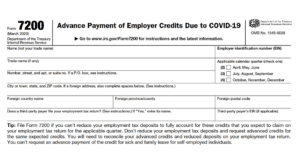

Internal Revenue Service guidance on various aspects of the recently passed economic stimulus bills continues to be released on a

With all of the commentary and focus on the potentially-forgivable Paycheck Protection Program loans included in the Coronavirus Aid, Relief

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_gtag_UA_60038340_2 | 1 minute | This cookie is installed by Google Analytics The cookie is used to throttle the request rate. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visited in an anonymous form. |