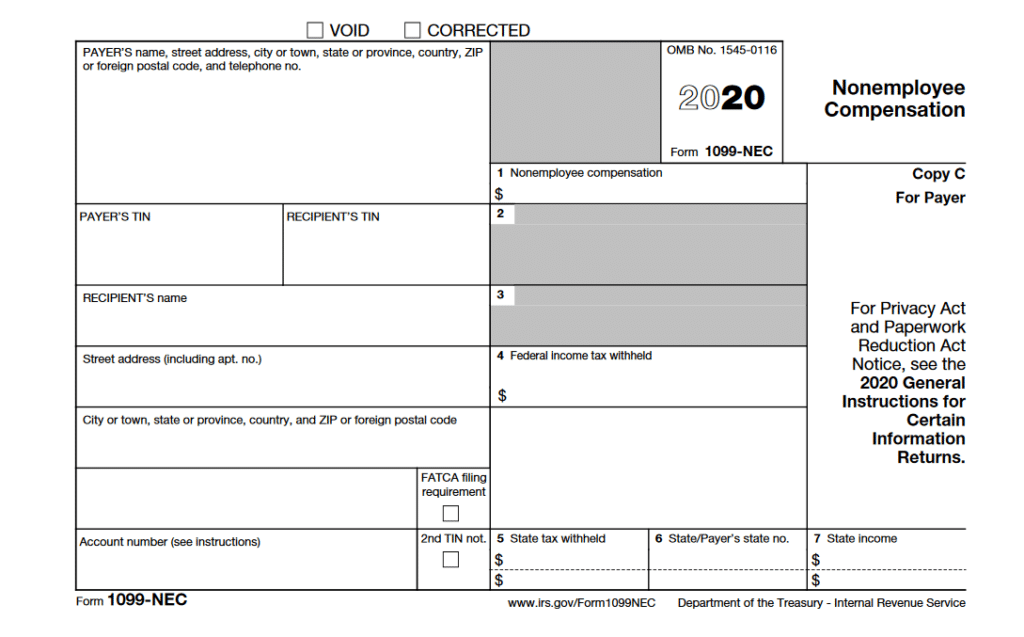

Classification of personal service providers as employees or independent contractors continues to be an area of controversy under the federal income tax law. To better identify payments to independent contractors, the Internal Revenue Service has now decided to reintroduce a prior Form 1099, not in use for almost four decades. Beginning with the 2020 tax year, the IRS will require business taxpayers to report nonemployee compensation (NEC) on the new Form 1099-NEC, instead of on Form 1099-MISC.

This is an important change as almost all companies are subject to annual reporting requirements involving these information returns. A failure to comply can lead to the imposition of penalties. Taxpayers may need to use both forms to report different types of payments. The 1099-NEC is to be used only to report payments of $600 or more made to nonemployees in the course of a trade or business. Form 1099-MISC will still be required to report other types of payments such as rent, royalties and healthcare.

Due to the creation of Form 1099-NEC, Form 1099-MISC was revised, and box numbers for reporting certain income were rearranged. Details about these changes and which types of payments should be included on each form can be found in the instructions for completing 1099-NEC and 1099-MISC.

Filing Requirements

According to the IRS instructions, if the following four conditions are met, you must generally report a payment as NEC:

- You made the payment to someone who is not your employee.

- You made the payment for services in the course of your trade or business (including government agencies and nonprofit organizations).

- You made the payment to an individual, partnership, estate, or, in some cases, a corporation.

- You made payments to the payee of at least $600 during the year.

Additionally, businesses will need to file Form 1099-NEC when they pay an individual at least $10 in royalties, or if the business has withheld any federal income tax for a nonemployee under the backup withholding rules, regardless of the amount of the payment.

The following are some examples of payments to be reported in box 1 of Form 1099-NEC:

- Professional service fees, such as fees to attorneys, accountants, architects, contractors, engineers, etc.

- Fees paid by one professional to another, such as fee-splitting or referral fees.

- Payments by attorneys to witnesses or experts in legal adjudication.

- Payment for services, including payment for parts or materials used to perform the services.

- Exchanges of services between individuals in the course of their trades or businesses.

- Benefits, commissions, prizes and awards paid to nonemployees.

Self-employed individuals can expect to receive Form 1099-NEC from any business that paid you $600 or more for nonemployee compensation in tax year 2020 or later. Personal payments made to self-employed individuals should not be reported on the 1099-NEC. The form should only be used to report payments made as compensation related to the company’s trade or business.

Filing Deadlines

The Form 1099-NEC carries with it a separate single filing deadline for all payments that use the form. The new form breaks out payments for nonemployee compensation (historically reported in box 7 of the 1099-MISC) to enable taxpayers to meet the accelerated filing deadline for reporting this type of income as set forth under the provisions of the PATH Act of 2015.

The primary purpose behind the required use of the new form was to help clarify the different filing deadlines that will be used starting with the 2020 tax year. The filing deadline for the 1099-NEC is February 1, 2021. The filing deadline for the 1099-MISC is March 1, 2021, for paper filing, and March 31, 2021, if filing electronically.

In addition to filing this new form with the IRS, businesses must also report the information to the appropriate states. Most states that support Form 1099-MISC have indicated that they also plan to require Form 1099-NEC to be filed to their state. However, the data contained on 1099-NEC will not be part of the IRS 1099 combined federal/state filing program, and will not be forwarded to the state taxing authorities.

If you have questions or need any assistance, please contact Bob Grossman, or Don Johnston at 412-338-9300.