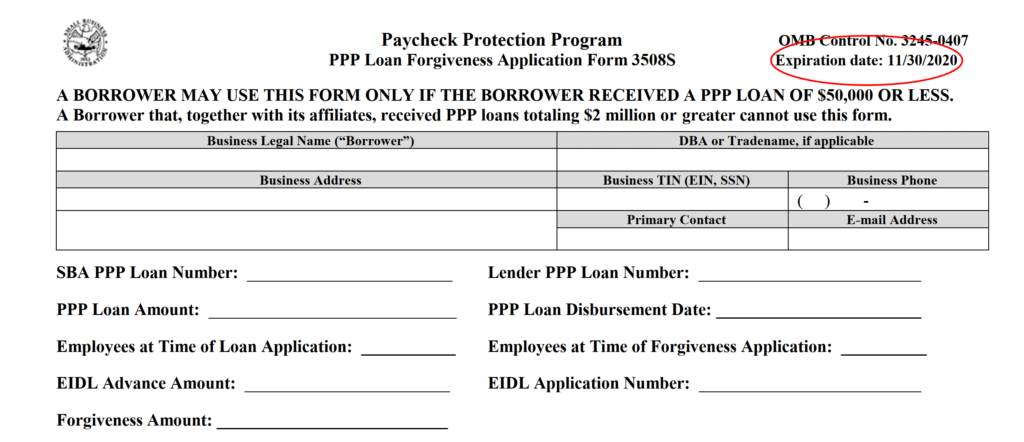

Some concerns had been raised regarding the expiration date found on the various Forms 3508 to be used to apply for forgiveness under the PPP loan program. When the first Form 3508 was released, it showed an expiration date in the upper right corner of October 31, 2020. The date on all three loan forgiveness forms has now been changed to November 30, 2020.

The issue came into sharper focus when the SBA released the streamlined PPP Loan Forgiveness Application Form 3508S in October with that very same expiration date (see related post). Some commentators and borrowers expressed a concern as to whether this might be the date by which borrowers would have to apply for forgiveness, and that date was rapidly approaching.

The SBA updated its PPP Loan Forgiveness FAQs on October 13, 2020 to address this concern, adding Question 4 on page 2 of the FAQ:

Question: The PPP loan forgiveness application forms (3508, 3508EZ, and 3508S) display an expiration date of 10/31/2020 in the upper-right corner. Is October 31, 2020 the deadline for borrowers to apply for forgiveness?

Answer: No. Borrowers may submit a loan forgiveness application any time before the maturity date of the loan, which is either two or five years from loan origination. However, if a borrower does not apply for loan forgiveness within 10 months after the last day of the borrower’s loan forgiveness covered period, loan payments are no longer deferred and the borrower must begin making payments on the loan. For example, a borrower whose covered period ends on October 30, 2020 has until August 30, 2021 to apply for forgiveness before loan repayment begins.

The expiration date in the upper-right corner of the posted PPP loan forgiveness application forms is displayed for purposes of SBA’s compliance with the Paperwork Reduction Act, and reflects the temporary expiration date for approved use of the forms. This date will be extended, and when approved, the same forms with the new expiration date will be posted.

This is the first time it appears the SBA has directly provided a specific deadline for applying for forgiveness, allowing borrowers to apply up until the maturity date of their PPP loan. Thus, even if a borrower fails to apply by the date 10 months after the end of the covered period and begins to make payments on the PPP loan, the borrower can still apply for forgiveness of the original PPP loan amount.

If you have questions about PPP loan forgiveness, please contact Bob Grossman, Don Johnston or Mike Weber at 412-338-9300.

Related Posts:

- Simpler Forgiveness Process for PPP Loans Under $50,000

- New Interim Final Rule Provides More PPP Loan Forgiveness Clarification

- More PPP FAQs Released by the SBA

- SBA Issues New PPP Loan Forgiveness FAQs

- New SBA Interim Final Rule Offers Further Guidance on PPP Loan Forgiveness

- Simpler PPP Forgiveness Application & Updated Program Guidance Released by SBA

- More PPP Changes and Enhancements on the Way

- SBA & Treasury Announce Forthcoming Updates to PPP Rules

- PPP Flexibility Act Signed Into Law

- SBA Offers Additional PPP Loan Forgiveness Information

- Paycheck Protection Program Loan Forgiveness Application Released

- Further SBA Guidance Extends Safe Harbor Deadline for PPP Loans

- Paycheck Protection Program Loans – Round 2

- FAQs Issued to Further Clarify Guidance on PPP Loans

- SBA Issues Additional Guidance for Paycheck Protection Program Loans

- Paycheck Protection Program Loans (PPP) Available Under the CARES Act