Occasionally, even tax law can become interesting to the casual observer. Such is the case with the long-awaited Tax Court decision on the value of Michael Jackson’s Estate, which has been open and unsettled for nearly 12 years following the passing of singer in 2009. In this recent case (Estate of Jackson v. Commissioner, T.C. Memo 2021-48, No. 17152-13, 5/3/21) the Tax Court ruled that the Internal Revenue Service (IRS) had overvalued the worth of the pop star’s image, likeness and other assets and determined a value of approximately $111 million – less than a quarter of the nearly $482 million figure determined by the IRS.

The Tax Court opinion filed on May 3, 2021, is an astounding 271 pages in length and serves to confirm the complexity of competent valuations prepared for purposes of the federal estate tax. The case is clearly a win for the Estate – and all taxpayers – as the expert for the government was found to be less accurate than those employed by the Estate. Embarrassingly for the IRS, the expert they engaged was even cited for perjury during the course of his work and testimony.

Value of the Estate at Time of Death

The essence of the case was, as noted, valuation. Mr. Jackson had been at the very pinnacle of the pop music world in the 1980s and 1990s but had fallen from public grace prior to his death due to allegations of inappropriate relationships with children. At his date of death he had not released any new recordings or performed any concerts for many years. Due to his alleged crimes and tarnished image he generated little or no income from using his likeness, and he died deeply in debt.

Shortly before his death, Mr. Jackson had fired his team of financial advisors and rehired the team he worked with during his earlier career successes. However, at his death Mr. Jackson’s new team did not yet have time to make an impact. After Mr. Jackson died, his advisors immediately took steps to begin to rehabilitate his image and likeness and developed plans for restoring the income opportunities available through such a restoration. Remarkably, they were quite successful in their efforts, and Mr. Jackson’s Estate attained and continues to hold the title of “Highest Earning Dead Celebrity” in a list published annually by Forbes.

IRS vs. Estate Determinations of Value

Numerous occurrences influenced the vast differences in value attained by the Estate and the IRS, and by the Court’s findings. Perhaps the most important was the success achieved by the new advisors after Mr. Jackson’s death.

The IRS struggled to bifurcate the value developed by posthumous decisions and strategies associated with the Estate and the value at the date of death. In 2013, the IRS conducted an audit of Mr. Jackson’s estate tax returns. As a result of this examination, the IRS determined that the Estate had underpaid its estate taxes by $500 million and added nearly $200 million in penalties.

While a number of asset values asserted by the Estate were challenged by the IRS, all disputes were successfully resolved except for the value the Estate had given to three specific intangible assets: Mr. Jackson’s image and likeness; the value of Mr. Jackson’s ownership interest in SONY/ATV (a music publishing company); and the value of Mr. Jackson’s ownership interest in Mijac (a company that owns copyrights to Mr. Jackson’s songs as well as others written by various musicians).

The Estate argued that, at the date of Mr. Jackson’s death, the Estate was in poor stead with heavy debt and little opportunity for future income generation. It was the thorough planning strategies of the Estate’s advisors after Mr. Jackson died that allowed the value of the Estate to rebound from the pre-death situation to the post-death earning engine it has become. As a result, the Estate argued that, at the date of Mr. Jackson’s death, the three intangible assets at issue had a much lower value than determined by the IRS.

The IRS did not agree, and the issue ultimately landed in Tax Court.

Tax Court Determination of Value

In the Tax Court opinion, Judge Mark Holmes noted that the Court “focuses on the nature of the estate tax as a tax on the privilege of passing on the property, not a tax on the privilege of receiving property.” While this statement may at first seem benign, the distinction evolving from that analysis is critical and significant.

A basic tenet of all valuation is that any such estimate is a “point-in-time” determination. As such, in measuring value, valuators are required under professional standards to incorporate into their analyses only those facts and circumstances that are “known or knowable” at the required point in time (in this case, date of death).

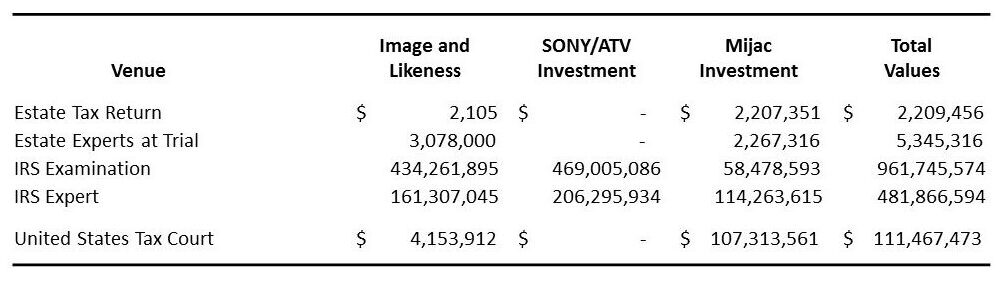

The Tax Court determined that the value subject to the federal estate tax is that value that Mr. Jackson held to pass on to his heirs at the time of his death. What those heirs did with the inherited assets after his passing, through the use of diligent management to increase their value, is not includible in Mr. Jackson’s Estate. The disputed asset values set forth by both sides in the case and the final values of the assets determined by the Court are summarized below. Explanations for the value determinations follow.

Image and Likeness

The greatest discrepancies in value were in respect to Mr. Jackson’s image and likeness, upon which the Court decided a final value of $4.15 million. The Estate’s experts had valued this asset at only $2,105 on the estate tax return due to the negative impact of the allegations against him. That amount was increased it to nearly $3.1 million at trial (about $1 million less than the Court’s finding) by the Estate’s experts. On the opposite extreme, the IRS declared a stunning value of almost $434.3 million during the estate tax return examination, but adjusted that amount to over $161.3 million at trial – a figure that was still nearly 400% more than the Court determined as correct!

According to the Court’s findings, the incredible disparity between the IRS’s argued values and the Court’s amount for his image and likeness was due to the IRS’s inclusion of assets that should not have been part of the intangible value of that asset. The Court determined that some of the additional amounts had been accounted for in the valuation of other assets of the Estate that had previously been agreed to by the parties. Additionally, the Court found that the IRS expert included assets that were not “known or knowable” at the point in time that the value should have been determined (Mr. Jackson’s death).

SONY/ATV Investment

With respect to Mr. Jackson’s ownership interest in SONY/ATV, the Court sided with the Estate, noting that Mr. Jackson had borrowed heavily against this asset during his lifetime, giving away significant bargaining rights to obtain that cash necessary to sustain his lifestyle needs. The Court further explained that both the IRS expert at trial and the IRS examiner failed to consider these items in conjunction with their determinations of value, set at nearly $206.3 million and just over $469 million, respectively. As a result of the IRS’s failure to consider these items, the Court dismissed their valuations and sided again with the Estate, agreeing with the expert’s determined a value of $0 for that asset. This decision was a major defeat for the IRS.

Mijac Investment

The IRS did gain somewhat of a victory in consideration of the value of the final Estate asset under dispute – Mr. Jackson’s ownership interest in Mijac. At trial, the Estate expert determined a value of just over $2.2 million, while the IRS expert set the amount at nearly $114.3 million (almost double the $58.5 million valuation established earlier by the IRS examiner). In its decision, the Court ruling was more in line with the value determined by the IRS expert, setting the value at $107.3 million for this asset.

Total Asset Values

In total, the Court found the three disputed assets to be worth approximately $111.5 million. This figure was still far more than the Estate’s determination of $5.3 million, but less than a quarter of the nearly $482 million valuation sought by the IRS. At the top federal estate tax rate of 45% in 2009 (not considering any state tax implications), the tax savings to the Estate as a result of this decision were in excess of $166 million.

Additional Penalties Due

After its examination of the estate tax return, which determined an Estate value of nearly $962 million, the IRS assessed an additional approximately $200 million in penalties due to understatement of value. The Court denied these penalties, noting that the Estate had taken steps necessary to correctly value some of the assets and had relied on reputable experts to determine appropriate value of the assets under challenge. This decision was also a big win for the Estate.

Points to Take Away from this Decision

An unfortunate element in this proceeding was the IRS expert’s total disregard for professional standards governing work performed by valuation specialists. In this case, it appears that the IRS expert was not acting independently or objectively but, rather, that he acted purely as an advocate for the IRS. It is disheartening to realize that this professional, as well as the entire IRS valuation group leadership team who were involved in this case, moved forward with these value assertions despite the fact that such action compromised professional standards and generally accepted valuation protocols. It is concerning that the IRS would take this road, knowing that their primary responsibility is enforcement of the tax laws and not the generation of revenue outside the reach of those laws.

For questions or comments about this case or valuation issues in general, please contact Bob Grossman or Melissa Bizyak at 412-338-9300.