Many states throughout the United States have implemented what are referred to as “pass-through entity tax elections” (PTET elections), since the proposed regulations outlined in IRS Notice 2020-75 were made effective as of November 9, 2020. The purpose of pass-through entity tax elections is to help individual taxpayers circumvent the limitation on the state and local tax (SALT ) itemized deduction implemented by the Tax Cuts and Jobs Act (TCJA) in 2018, which capped the SALT deduction at $10,000 for taxpayers (single or married).

GYF has posted previously on SALT and PTET issues (see related posts link at the bottom of this article), but wanted to provide an update since there has been recent action on this front that may impact our clients. This AICPA Journal of Accountancy article provides an update on recent PTET legislation progress from several states.

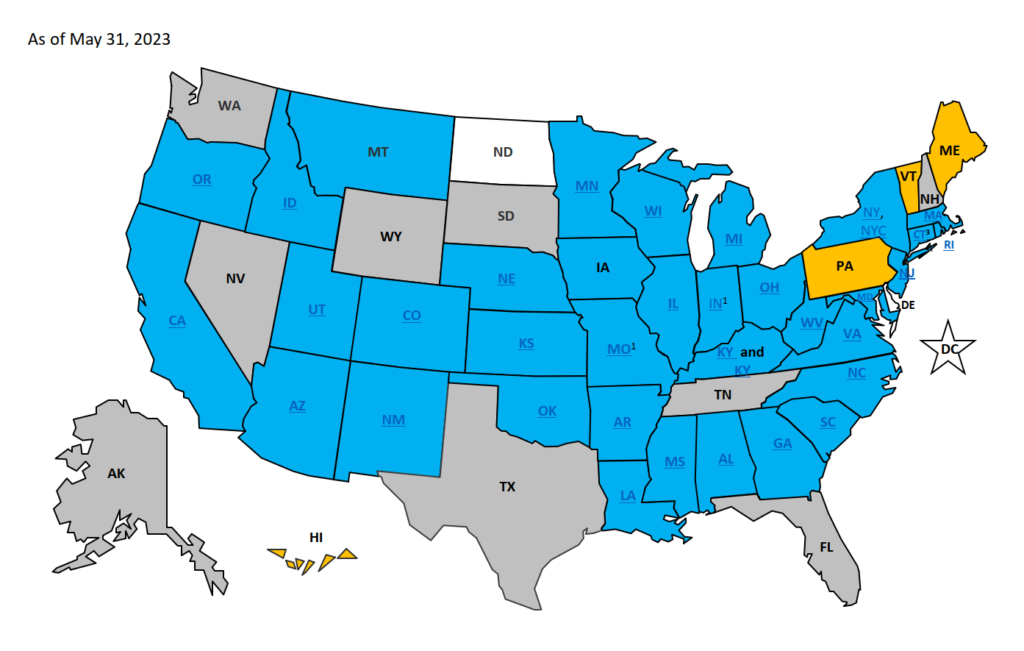

West Virginia recently joined a group of 36 states that currently have some type of PTET election in place after enacting legislation on March 28, 2023. Visit the WV.gov website for more details. Pennsylvania remains one of just seven states that imposes an income tax on individuals but has yet to implement a pass-through entity tax election. However, Pennsylvania does have a proposed PTET bill in the works. This is a hopeful sign for Pennsylvania taxpayers and something that GYF will continue to monitor.

On May 3, 2023, PA Senator Ryan Aument introduced Senate Bill 659, which provides for an optional pass-through entity tax, to the Finance Committee. At the same time, Senator Aument also introduced Senate Bill 660 to the Finance Committee to rectify an issue related to the inadvertent impact of other states’ PTET on Pennsylvania resident taxpayers.

Pennsylvania taxes its residents on all of their income, without regard to where it is earned. Under this policy, a PA resident could pay tax in other states on income that is also taxed in Pennsylvania. Generally, Pennsylvania permits residents to claim a credit for the amount of personal income tax (PIT) they pay to other (nonresident) states to prevent this double-taxation. Currently, Pennsylvania-resident business owners are not permitted to claim this credit specifically on PTET income from other states. As such, certain Pennsylvania resident business owners who try to utilize a PTET election in other states must sacrifice their Pennsylvania credit for taxes paid to other states on that income. Proposed SB 660 would extend the ability to claim PA resident credits for PIT paid to other states to certain owners of pass-through entities rather than limiting it to individual taxpayers.

As the law currently stands, Pennsylvania-resident business owners should be mindful of this potential limitation to their PA returns prior to making a PTET election in another state. Please contact a GYF professional if you would like assistance in this determination.

We will continue to monitor any legislative progress on these issues provide updates as available. Please contact GYF at 412-338-9300 if you have questions or need assistance with PTET elections or other tax issues.

Related Posts: