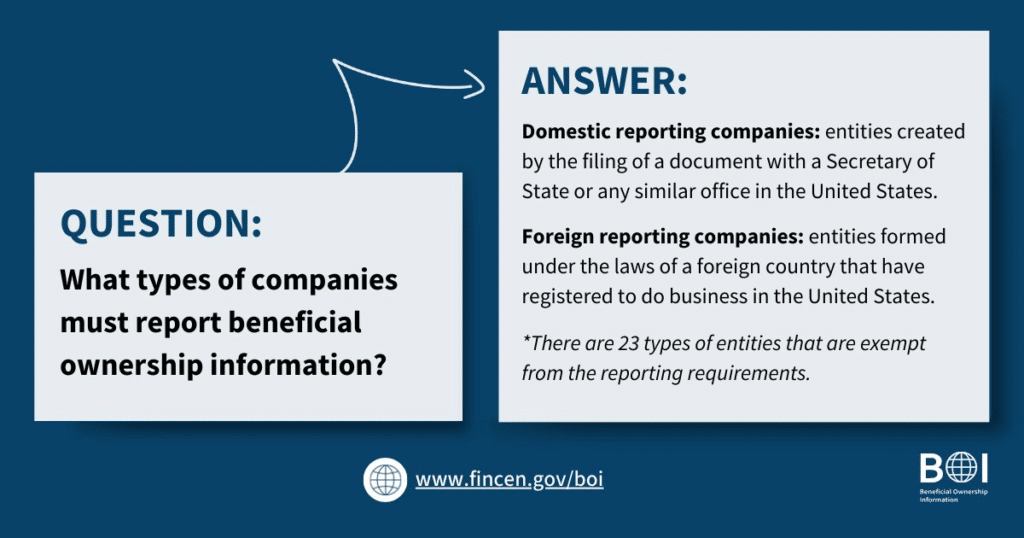

As explained in a previous blog post, the Federal Corporate Transparency Act (CTA), which was passed in early 2021, requires certain reporting entities to file beneficial ownership information (BOI) reports with the Financial Crimes Enforcement Network (FinCEN). As a reminder, a beneficial owner is any individual who owns or controls at least 25% of the ownership interests of a reporting company or who directly or indirectly exercises substantial control over a reporting company.

A new BOI reporting requirement went into effect January 1, 2024. Since then, FinCEN has provided updates and clarifications through an extensive FAQs page, which has grown to include over 100 FAQs that cover 15 different categories. FinCEN issued its latest series of updates to the BOI FAQs on July 8, 2024; there were also additions in April and June. These changes are reviewed briefly below. (Click on the links for detailed explanations)

Dissolved Entities

Several recent additions (C.12–C.14 & D.17) clarify filing requirements with respect to dissolved entities and confirm that entities dissolving in 2024 must file BOI reports even if the dissolution is final before the deadline of their BOI reports.

Indian Tribes

Two new updates address reporting requirements for Indian Tribes and entities formed under Tribal law (A.5 & C.11). Under the CTA, an “Indian Tribe” includes any Indian or Alaska Native tribe, band, nation, pueblo, village, or community recognize on the list published annually in the Federal Register. Entities formed under Tribal law must report beneficial ownership information if they meet the definition of a reporting company and do not qualify for exemptions. Legal entities created by filing documents with Tribal offices or agencies, similar to state secretaries of state, are considered reporting companies.

Category C – Reporting Company

Several recent updates, in addition to the ones noted above, were added in this section. Specifically, the FAQs confirm that BOI reporting requirements apply to S Corporations that are treated as pass-through entities under Subchapter S of the Internal Revenue Code. (C.8) If a domestic corporation or LLC is not created by filing a document with the secretary of state or similar office, it is not considered to be a reporting company according to FinCEN. Another new development addresses whether Homeowners Associations are reporting companies. (C.10) This determination depends on how the HOA was formed.

Category D – Beneficial Owner

This section contains various updates specifically related to trusts. Several FAQs updated in April address who is considered a beneficial owner of a reporting company (D.1), homeowners association (D.13), and trusts that are owned or controlled by individuals (D.14 & D.15). Category D also addresses how a reporting company is to report a corporate trustee as a beneficial owner, (D.16) which is dependent upon the interest owned in the reporting company through the interest owned in the corporate trustee.

Category F – Reporting Requirements

Updates to this section include a list of documents accepted as identification (F.5) as well as details for address reporting for a company that lacks a principal place of business in the United States (F.12)

Category G – Initial Report

A new FAQ in this section addresses how long a reporting company has to file its initial BOI report after losing its exempt status. (G.6)

Category K – Compliance/Enforcement

An updated item in this section details the penalties individuals face for violating BOI reporting requirements, such as being subject to civil penalties of up to $500 for each day the violation continues. (K.2)

Category L – Reporting Company Exemptions

Several new FAQs related to companies that are exempted from the reporting requirements were recently added to this section. These updates include reporting criteria for a company that fluctuates in size above and below the thresholds for the large operating company exemption (L.7); details for telecommunications companies to qualify for the public utility company exemption (L.8); and how to qualify for the large operating company exemption without a prior year tax filing. (L.9)

Category O – Access to Beneficial Ownership Information

This category covers questions such as how and when authorized recipients will have access to beneficial ownership information, which FinCEN plans to take in a 5-phase approach. (O.1) Further, the FAQs address how State and Federal agencies are able to request beneficial ownership information. (O.2 & O.3) This section also details the restriction from Foreign governments gaining access to the BOI IT system unless provided through an intermediary Federal Agency. (O.4)

Category O also briefly addresses how authorized recipients should prepare to receive, store, and use beneficial ownership information (O.5) as well as describing expectations for financial institutions subject to customer due diligence requirements (O.6) if/when they are granted access to the information. Although it is currently not permitted, FinCEN anticipates extending access to the BOI IT system to financial institutions, subject to customer due diligence requirements under applicable law, in the spring of 2025.

Final Thoughts

Updates continue to trickle in as FinCEN offers further clarity to potential reporting companies that are subject to the BOI reporting requirements under the Corporate Transparency Act. The focus from these new updates draws attention to how exemptions are aimed at limiting redundancies in reporting obligations for entities with separate regimes. Nevertheless, the new answers to the FAQs reinforce that potential reporting companies should be proactive in addressing their reporting obligations, as the CTA is vastly applicable to non-exempt entities.

In addition to the FAQs, FinCEN offers a variety online resources as well as an introductory video and a more detailed informational video about the reporting requirement, to assist taxpayers.

Related Posts: