SBA & Treasury Announce Forthcoming Updates to PPP Rules

The Small Business Administration (SBA) and the U.S. Treasury issued a joint statement on June 8, 2020, announcing forthcoming updated

The Small Business Administration (SBA) and the U.S. Treasury issued a joint statement on June 8, 2020, announcing forthcoming updated

On June 8, 2020, Pennsylvania Governor Tom Wolf announced a $225 million grant program to support the State’s small businesses

On June 5, 2020, President Trump signed the Paycheck Protection Program Flexibility Act of 2020 (H.R. 7010) into law. The

The bipartisan House-approved Paycheck Protection Program Flexibility Act (H.R. 7010) was passed on June 3, 2020, after Senate Majority Leader

The House of Representatives overwhelmingly approved the Paycheck Protection Program Flexibility Act (H.R. 7010) on May 28, 2020. The bill

A week after releasing the long-awaited Paycheck Protection Program (PPP) Loan Forgiveness Instructions and Application on May 15, 2020, the

Even as borrowers of the Paycheck Protection Program (PPP) loans begin the process of applying for loan forgiveness, and though

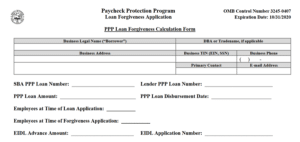

The Small Business Administration (SBA), in consultation with the U.S. Department of Treasury released their Paycheck Protection Program (PPP) loan

With pressure mounting and a looming potential deadline for borrower amnesty for Paycheck Protection Program (PPP) loans inappropriately taken, the

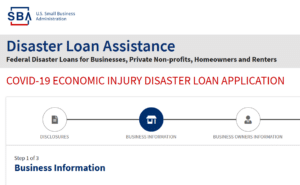

Though not noted in its recent news release announcing that the application portal would reopen for certain agricultural businesses now

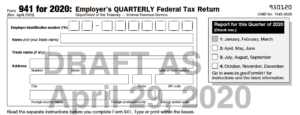

The Coronavirus Aid, Relief and Economic Security (CARES) Act as well as the Families First Coronavirus Response Act (FFCRA), both

IRS Notice 2020-32, released last week, clarified that expenses paid with proceeds from a Paycheck Protection Program (PPP) loan will

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gat_gtag_UA_60038340_2 | 1 minute | This cookie is installed by Google Analytics The cookie is used to throttle the request rate. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visited in an anonymous form. |