GYF Has Presented Webinars on PPP Loans and Related Topics

Search by Keyword

Search By Category

Relief Program for Shuttered Venue Operators to Open April 8

The U.S. Small Business Administration (SBA) recently released additional details about their Shuttered Venue Operators Grant (SVOG) application portal in advance of opening applications for the much-anticipated economic relief program

Pennsylvania Delays Tax Due Date

Following the lead of the IRS, which recently announced an extension of the filing deadline for federal income taxes for individuals, many states, including Pennsylvania, have given taxpayers an extra

IRS Extends Filing Deadline for Individual Federal Income Taxes

In response to growing pressure from several professional organizations and Congressional leaders (see recent post), the Internal Revenue Service has extended the federal income tax filing due date for individuals.

Unemployment Compensation May Be Tax-Free for 2020

The Senate version of the American Rescue Plan of 2021, signed into law on March 11, 2021, by President Biden, added a special rule that applies to unemployment compensation for

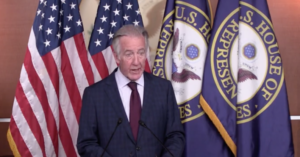

House Ways and Means Chair Joins Call for Tax Deadline Extension

In a press release issued on March 8, 2021, Chairman of the House Ways and Means Committee Richard Neal (D-MA) has joined others in the call for the Treasury Department

$1.9 trillion American Rescue Plan Act of 2021 Signed into Law

The American Rescue Plan Act of 2021 (ARP or “the Act”) was signed into law by President Biden on March 11, 2021. The $1.9 trillion package follows the 2020 enactment

Relief for Hospitality Industry on Tap

Long-awaited relief is on the way for Pennsylvania business owners in an industry that has been hit hard by the global pandemic. Restaurants, bars and other hospitality businesses that were

President Biden Announces PPP Loan Changes to Aid Smaller Businesses

On February 22, 2021, President Biden announced new efforts to refocus federal pandemic assistance by targeting the nation’s smallest businesses through enhanced access to the Paycheck Protection Program (PPP). The

Where to Get Answers and Assistance

General Guidance and Links to Resources

- Allegheny Conference on Community Development COVID-19 page

- Manufacturer & Business Association COVID-19 employer resources

- Pittsburgh Business Journal Small Business Resource Guide

- ACIPA – audit and accounting guidance related to COVID-19

- PICPA – resources and updates for Pennsylvania CPAs

- Small Business Owners Guide to the CARES Act

- Advising Amid Uncertainty

Information for Not-for-Profit Organizations

- National Council of Nonprofits – articles, webinars and other resources

- Nonprofit Finance Fund – tools and resources to help manage finances

- Independent Sector – Links, legislative summaries and webinars

- Pennsylvania Association of Nonprofit Organizations (PANO)

- Pittsburgh Foundation COVID-19 webinar series

- Pittsburgh Emergency Action Fund

- National Artist Relief Fund

Access Past GYF Webinars

PPP Part IV – 2nd Draw PPP Loans & ERC Expansion (1/21/21)

PPP Part III – Loan Forgiveness Updates (12/17/20)

PPP Part II – Loan Forgiveness and Current Developments (5/29/20)

Paycheck Protection Program – Forgiveness and Procedures (5/1/20)

Not-for-Profit Organizations – Welcome to the Next Normal (5/27/20)

Information About COVID-19

Click here to learn more about how you can help prevent the spread of the virus.

For the latest news, visit the CDC website.

View guidance from the CDC for safe reopening recommendations and best practices for cleaning and disinfecting public spaces.