GYF Has Presented Webinars on PPP Loans and Related Topics

Search by Keyword

Search By Category

Deductibility of Expenses Paid with PPP Loan Proceeds Clarified

On November 18, 2020, the Treasury Department and the Internal Revenue Service released additional guidance on the deductibility (or rather, the non-deductibility) of certain covered payroll and non-payroll expenses paid

Due Date for Contributions to Defined Benefit Plans Set by CARES Act Extended

The Coronavirus Aid, Relief and Economic Security Act (CARES Act) included a number of relief provisions intended to provide taxpayers a recess on due dates for certain items requiring cash

SBA Issues Notice Relating to Its Assessment of Economic Uncertainty

The Small Business Administration (SBA) recently issued a Notice providing additional details that may affect companies participating in the Paycheck Protection Program (PPP) offered in the Coronavirus Aid, Relief, and Economic

SBA Clarifies Filing Date(s) for PPP Loan Forgiveness

Some concerns had been raised regarding the expiration date found on the various Forms 3508 to be used to apply for forgiveness under the PPP loan program. When the first

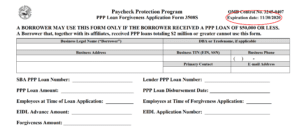

Simpler Forgiveness Process for PPP Loans Under $50,000

On October 8, 2020, the Small Business Administration, in consultation with the Treasury Department, released a simpler loan forgiveness application for Paycheck Protection Program (PPP) loans of $50,000 or less.

Accounting for Paycheck Protection Program Loans

Much attention has been focused on the Small Business Administration’s Paycheck Protection Program (PPP) Loans, especially with regard to interpretation of various provisions and on the process under which all

In the Nick of Time, IRS Issues Guidance on Employee Social Security Tax Deferral

With extraordinarily poor timing, the Treasury Department and the Internal Revenue Service have finally issued guidance (Notice 2020-65) allowing employers to defer certain employee payroll tax obligations for the remainder

New Interim Final Rule Provides More PPP Loan Forgiveness Clarification

On August 24, 2020, The U.S. Small Business Administration (SBA) and Treasury issued an interim final rule addressing Paycheck Protection Program (PPP) forgiveness issues related to owner-employee compensation and the

Where to Get Answers and Assistance

General Guidance and Links to Resources

- Allegheny Conference on Community Development COVID-19 page

- Manufacturer & Business Association COVID-19 employer resources

- Pittsburgh Business Journal Small Business Resource Guide

- ACIPA – audit and accounting guidance related to COVID-19

- PICPA – resources and updates for Pennsylvania CPAs

- Small Business Owners Guide to the CARES Act

- Advising Amid Uncertainty

Information for Not-for-Profit Organizations

- National Council of Nonprofits – articles, webinars and other resources

- Nonprofit Finance Fund – tools and resources to help manage finances

- Independent Sector – Links, legislative summaries and webinars

- Pennsylvania Association of Nonprofit Organizations (PANO)

- Pittsburgh Foundation COVID-19 webinar series

- Pittsburgh Emergency Action Fund

- National Artist Relief Fund

Access Past GYF Webinars

PPP Part IV – 2nd Draw PPP Loans & ERC Expansion (1/21/21)

PPP Part III – Loan Forgiveness Updates (12/17/20)

PPP Part II – Loan Forgiveness and Current Developments (5/29/20)

Paycheck Protection Program – Forgiveness and Procedures (5/1/20)

Not-for-Profit Organizations – Welcome to the Next Normal (5/27/20)

Information About COVID-19

Click here to learn more about how you can help prevent the spread of the virus.

For the latest news, visit the CDC website.

View guidance from the CDC for safe reopening recommendations and best practices for cleaning and disinfecting public spaces.