GYF Has Presented Webinars on PPP Loans and Related Topics

Search by Keyword

Search By Category

AICPA Addresses 2020 ERC Calculation and “Over-Reported” Payroll on Certain First Draw PPP Loans

The Taxpayer Certainty and Disaster Relief Act (TCDRA) of 2020, part of the Consolidated Appropriations Act, 2021 (CAA), included an important provision allowing taxpayers/employers who availed themselves of a First

NOL Procedures Under the CARES Act Offer Tax-Saving Opportunities

The rules for business net operating losses (NOLs) have undergone several changes in recent years. Under the tax reform law known as the Tax Cuts and Jobs Act (TCJA), signed

Employers Urged to Take Advantage of the Extended Employee Retention Credit

In IR-2021-21, issued on January 26, 2021, the Internal Revenue Service encourages employers to take advantage of the newly-extended Employee Retention Credit (ERC), which makes it easier for businesses that

SBA Updates PPP Loan Forgiveness Forms

On January 19, 2021, the U.S. Small Business Administration (SBA) and Treasury published updated Paycheck Protection Program (PPP) loan forgiveness guidance and forms. The newly released forms include: PPP Loan

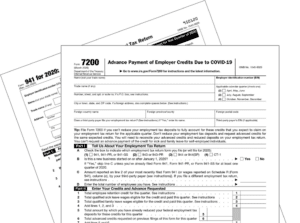

Tax Forms Available to Obtain Stimulus Credits (Including the ERC)

The Consolidated Appropriations Act, 2021 (CAA) and the Economic Aid Act, set forth therein, have extended and expanded the Employee Retention Credit (ERC) affording many taxpayers yet another avenue of realizing

SBA Issues Guidance for New PPP Loan Applications

In anticipation of the revised PPP loan process opening to all lenders on January 19, 2021, the U.S. Small Business Administration (SBA) released procedural guidance for borrowers who wish to

Consolidated Appropriations Act, 2021 Enhances the Employee Retention Credit

While most business professionals have at least a passing understanding of the PPP, far fewer have spent time looking at the ERC. This post provides additional details. GYF will also

SBA Opens New Round of PPP Loans

UPDATED JANUARY 14, 2021 On January 8, 2021, the U.S. Small Business Administration (SBA), in consultation with the Treasury Department, announced that the Paycheck Protection Program (PPP) will re-open

Where to Get Answers and Assistance

General Guidance and Links to Resources

- Allegheny Conference on Community Development COVID-19 page

- Manufacturer & Business Association COVID-19 employer resources

- Pittsburgh Business Journal Small Business Resource Guide

- ACIPA – audit and accounting guidance related to COVID-19

- PICPA – resources and updates for Pennsylvania CPAs

- Small Business Owners Guide to the CARES Act

- Advising Amid Uncertainty

Information for Not-for-Profit Organizations

- National Council of Nonprofits – articles, webinars and other resources

- Nonprofit Finance Fund – tools and resources to help manage finances

- Independent Sector – Links, legislative summaries and webinars

- Pennsylvania Association of Nonprofit Organizations (PANO)

- Pittsburgh Foundation COVID-19 webinar series

- Pittsburgh Emergency Action Fund

- National Artist Relief Fund

Access Past GYF Webinars

PPP Part IV – 2nd Draw PPP Loans & ERC Expansion (1/21/21)

PPP Part III – Loan Forgiveness Updates (12/17/20)

PPP Part II – Loan Forgiveness and Current Developments (5/29/20)

Paycheck Protection Program – Forgiveness and Procedures (5/1/20)

Not-for-Profit Organizations – Welcome to the Next Normal (5/27/20)

Information About COVID-19

Click here to learn more about how you can help prevent the spread of the virus.

For the latest news, visit the CDC website.

View guidance from the CDC for safe reopening recommendations and best practices for cleaning and disinfecting public spaces.